ISLAMABAD – The Central Directorate of National Savings (CDNS) or Qaumi Bachat offers an attractive investment options to those who are interested in short-term investment with a reasonable profit rate.

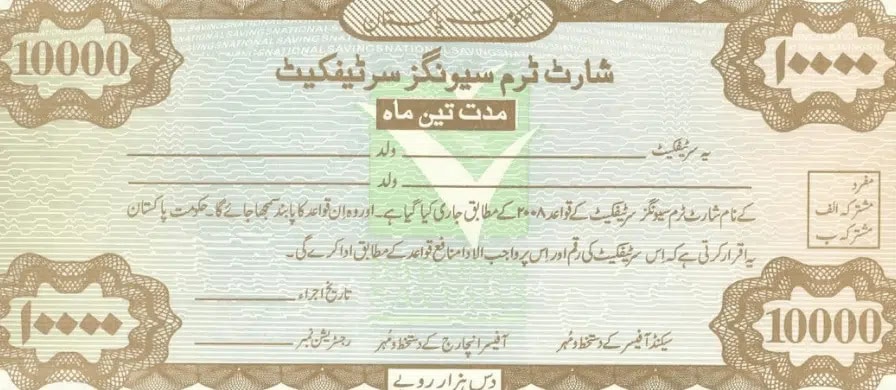

The Short Term Savings Certificates, which were first launched in 2012, designed specifically to meet the short term funding needs of the investors with maturity period of 3-months, 6-months & 1-year.

It is pledge-able and having 3-month, 6-month and 1-year maturity scheme and all Pakistani nationals as well as Overseas Pakistanis can make investment in it.

An investor can deposit minimum Rs10,000 in this category while there is no maximum limit.

The directorate last revised the profit rate on Short Term Savings Certificates in December 2024 and it is still applicable.

Short Term Savings Certificates Profit Rate from Jan 2025

The profit rate for three-month maturity has been fixed at 12.76 percent or Rs3,190 on investment of each Rs100,000 as compared to previous 14.32% or Rs3,580.

However, the profit rate for six-month maturity category has been set at 12.74% or Rs6,370 as compared to previous 13.46% or Rs6,730. However, the profit from 12-month maturity has been fixed at Rs12,380 or 12.38%.

Tax Deduction on STSC Profit Rate

As per the policy, investors appearing in Active Taxpayer List will pay 15% in wake of withholding tax on the total profit.

However, the authorities will charge 30% of the yield/profit irrespective of date of investment and amount/profit.