The overseas Pakistani workers’ remittances grew by 6.1% during the Fiscal Year 2022 to reach $31.2 billion against the total inflows of $29.45 billion in FY2021.

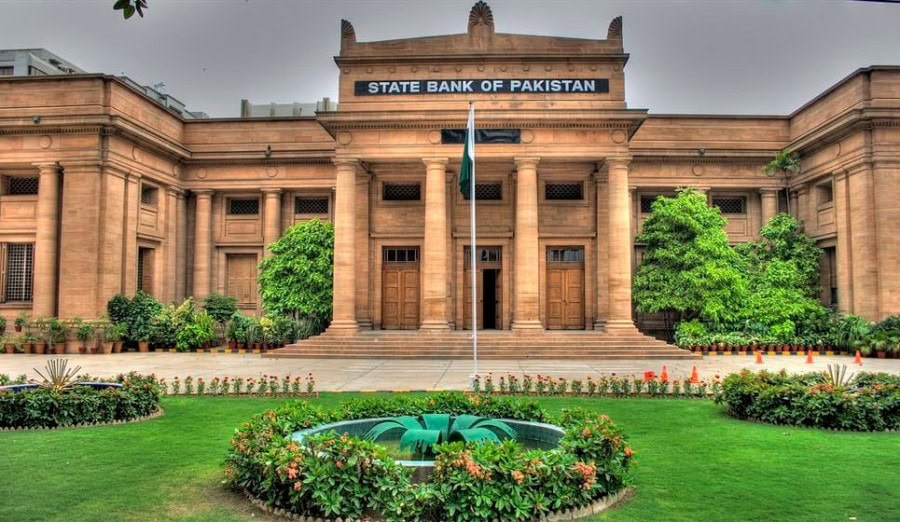

According to the data shared by the State Bank of Pakistan (SBP), $2.76 billion of remittances were recorded during June of the FY22, compared to $2.3 billion in May 2022, an increase of $428.5 million or 18.4% on a month-on-month basis.

However, compared to the same month last year, a growth of 1.7% was witnessed in June 2022 – from $2.714 billion to $2.76 billion.

Cumulatively, the total inflow during FY22 reached $31.2 billion, with the State Bank saying this inflow was “anticipated”.

As anticipated, remittances in FY22 rose to a record $31.2 bn, up 6% compared to FY21. In June, they rose to $2.8 bn, increasing by 18% compared to May 22 and 2% compared to Jun 21. See: https://t.co/7XBd4uNES4

Visit #EasyData to view interactive chart https://t.co/bOIQjODIsE pic.twitter.com/Hrj8fiXNjy— SBP (@StateBank_Pak) July 18, 2022

Saudi Arabia tops the list of the biggest contributor via workers’ remittances with $7.743 billion during FY22, up from $7.726 billion recorded in the same period of the previous fiscal year.

On the other hand, inflows amounted to $5.842 billion from the United Arab Emirates, registering a growth of 5%. An inflow of $4.487 billion was recorded from the United Kingdom and $3.082 billion from the US.

Pakistan heavily depends on the influx of remittances to meet its foreign exchange needs because exports hardly cover the high level of imports.

Read: Whopping $48.2bn trade deficit recorded during FY22

The SBP reports that as of July 7, 2022, the nation’s total liquid foreign exchange reserves were $15.611 billion, down from $15.742 billion as of June 30, 2022, a decline of $132 million over the previous week.

Read: Forex reserves drop by $132mln: SBP

Due to payments on external debt, SBP’s reserves fell by $99 million during the week under review. By the conclusion of the previous week, SBP’s foreign exchange reserves had dropped from $9.816 billion to $9.717 billion. Additionally, the $5.893 billion in net foreign reserves held by commercial banks fell by $33 million.