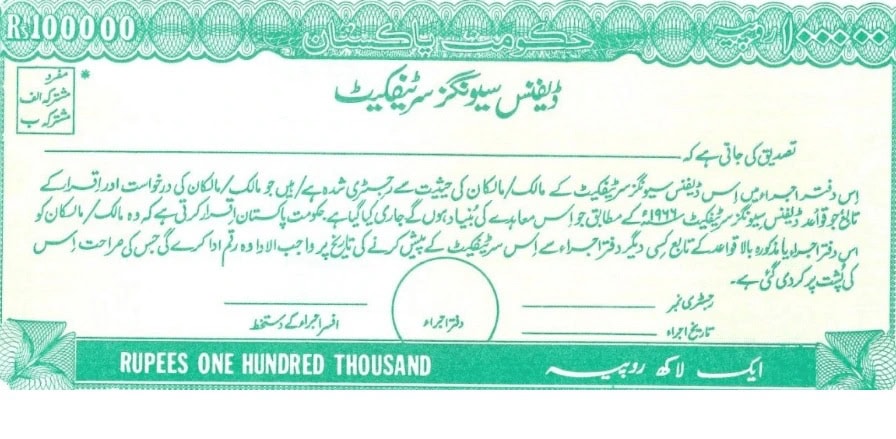

ISLAMABAD – The federal government introduced the Defence Savings Certificates (DSCs) scheme decades ago with an aim to help long term investors cater their financial needs.

The Qaumi Bachat Bank or National Savings offers up to 10 years maturity plan so investors can enjoy maximum benefit or profit on their savings.

With effect from October 2024, the National Savings or Qaumi Bachat Bank has announced new profit rate for Defence Savings Certificates.

Who Can Invest in DSCs?

Both Pakistani nationals and overseas Pakistanis can invest in the Defence Savings Certificates. These certificates have a maturity period of 10 years and come in denominations of Rs.500, Rs.1,000, Rs.5,000, Rs.10,000, Rs.50,000, Rs.100,000, Rs.500,000, and Rs.1,000,000.

Defence Savings Certificates Profit from November 2024

From November 2024, the profit rate for Defence Savings Certificates has been fixed at to 12.51 percent as previously it stood at 13.57% in Pakistan. Following are the profits on completion of every year until 10 years maturity on investment of 100,000:

First Year Rs108,000

Second Year Rs117,000

Third Year Rs127,000

Fourth Year Rs140,000

Fifth Year Rs156,000

Sixth Year Rs177,000

Seventh Year Rs203,000

Eighth Year Rs235,000

Ninth Year Rs275,000

Tenth Year Rs325,000

Tax/Zakat Deduction

The taxes and Zakat are deducted on the profits in line with the policy of the State Bank of Pakistan.

The withholding tax for filers has been fixed at 15 percent while it is 30 percent for non-fielders.