ZUBAIR YAQOOB

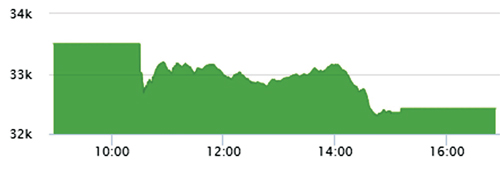

KARACHI Market opened -478pts on Tuesday and continued the descent throughout the session, which extended to -1199pts by the end of session. The benchmark index closed -1078pts. Concerns raised by IMF over G20 debt relief, announced last week by the Government, as well as hinting higher than expected inflation with a caution over the Policy rate cut caused the market to panic. In addition, onslaught on WTI and Brent prices in the international market kept the bears active in Oil & Gas scrips, which saw OGD, PPL, POL, PSO, HASCOL on lower circuit breakers by the end of session. Banking sector stocks also adjusted downward by close. Cement sector saw an initial selling pressure, but rallied on the hint of Cement prices to be increased in the coming days. Nonetheless, overall negative sentiment couldn’t save Cement sector stocks from selling pressure. Cement sector garnered 151.3M shares in trading volumes, followed by O&GMCs (28.6M) and Technology (21.4M). Among scrips, MLCF realized 39.6M shares, followed by FCCL (35.5M) and HASCOL (23M). The Index closed at 32,422pts as against 33,500pts showing a decline of 1077pts (-3.2% DoD). Sectors contributing to the performance include E&P (-288pts), Fertilizer (- 175pts), Power (-136pts), Banks (-124pts) .