The District Collector Rate, commonly known as DC rate, is essentially a minimum value of properties set by the government on basis of the location and other factors.

The DC rate serves as a benchmark for determining the taxes and duties associated with property transactions and property valuation.

This rate is set by the District Collector or an equivalent authority and is used to ensure that property transactions are recorded at a minimum value, which helps in accurate tax collection.

The DC rate also helps to curb undervaluation and tax evasion.

How to Access DC Rate List in Punjab

In major cities like Lahore and Multan, you can access the DC Rate list through local government’s official website.

You can also get it from the local revenue office or District Collectorate usually maintains records of the DC Rates and can provide information upon request.

Following factors determine DC rate of properties:

Location

Tehsil

District

City or town

Revenue circle

Floor

Property type

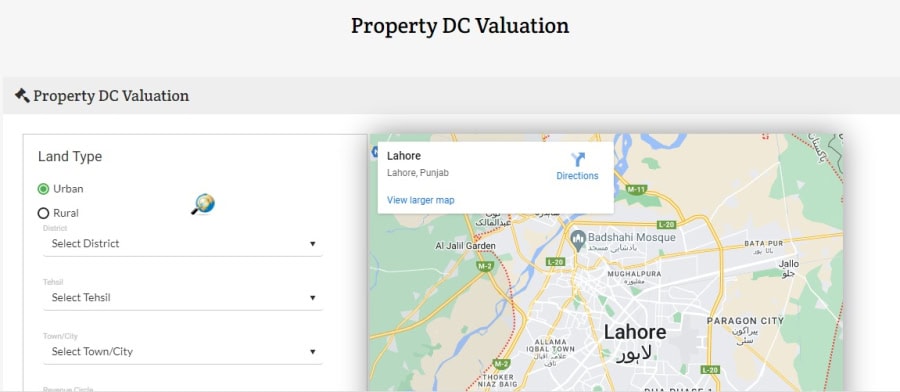

Calculate DC Rate of Properties Online

You can visit the official website of e-stamping of the Punjab government to online check the Property DC Valuation.

You will require to enter details of land type, location, land classification and area size to find the land rate online.