The Pakistan stock market crashed on Thursday while the rupee also maintained its downturn amid rising concerns related to stagflation and a deepening economic crisis.

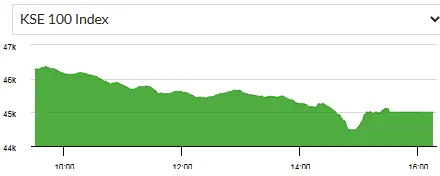

Pakistan Stock Exchange’s benchmark KSE-100 Index dropped by over 1,750 points or almost 3.8%, slipping well below 44,500 points.

Topline Securities CEO Muhammad Sohail said “stocks are down another 1,750 points due to the non-stop fall in the rupee”.

Dealers reported that the Pakistani rupee declined by Rs1.50, hitting a new all-time low of Rs305.55 against the greenback around noon.

The local currency continued its record breaking downward spree in the wake of speculative demand for the greenback in the domestic economy. Market talk suggests that the government’s view of the current economic crisis in Pakistan is the primary reason for causing panic in capital markets.

Investors reacted with panic to the rising rupee-dollar parity, opting to offload shares on fears of a looming economic turmoil.

The dominant sentiment in the market is that caretaker Finance Minister Shamshad Akhtar should give a policy statement as to how the incumbent government will tackle the crisis.

To recall, PSX is reeling after hitting a six-year high at over 49,000 points in July in the wake of the acquisition of a new International Monetary Fund loan programme of $3 billion in late June 2023. The currency has depreciated by 5% or Rs17 under the first two weeks of the caretaker government.

Capital markets are also melting due to high political temperatures in the country, leading to uncertainty over when the next general elections, which were initially speculatively slated for November 2023, will be held.