Zubair Yaqoob

Karachi

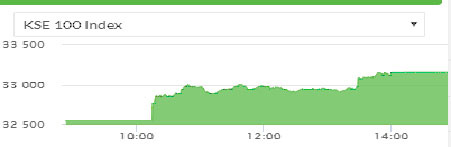

Market opened on a positive note on Wednesday with +211pts at the opening bell. The benchmark index gained 605pts during the session and closed at session’s high. Oil stocks got traction from positive trend in international crude oil price (WTI) that increased by 14% and helped E&P stocks to post price gains. Cement sector maintained the momentum throughout the day, except for realizing profit booking by the end of session, showing signs of regression in DGKC. Banking sector stocks also stay muted amid low volumes, due to prospects of rate cut. Cement sector posted highest trading volumes with 43.9M shares, followed by O&GMCs (11.8M) and E&P (10.8M). Among scrips, MLCF topped the volumes with 18.4M shares, followed by HASCOL (8.2M) and DGKC (7.3M). The Index closed at 33,159pts as against 32,553pts showing an increase of 605pts (+1.9% DoD). Sectors contributing to the performance include E&P (+177pts), Power (+121pts), Fertilizer (+85pts), Cement (+67pts), Inv Banks (+33pts) and Banks (-22pts). Volumes declined from 157.9mn shares to 140.5mn shares (-11% DoD). Average traded value, on the contrary, increased by 31% to reach US$ 47.6mn as against US$ 36.3mn. Stocks that contributed significantly to the volumes include MLCF, HASCOL, DGKC, EFERT and PIOC, which formed 33% of total volumes. Stocks that contributed positively to the index include HUBC (+116pts), OGDC (+61pts), POL (+50pts), FFC (+45pts) and LUCK (+39pts).