ISLAMABAD – The registration of mobile phones, brought by overseas Pakistanis or foreign nationals in the country, is completed in Device Identification Registration and Blocking System (DIRBS) after the payment of applicable taxes and duties imposed by the Federal Board of Revenue (FBR).

The registration process also includes the verification of technical requirements by Pakistan Telecommunication Authority (PTA).

DIRBS is a system designed to identify non-compliant devices operating on local mobile networks. It automatically registers compliant devices operating on the mobile networks and eventually blocks non-compliant devices.

DIRBS objective is to ensure a healthy growth of mobile device ecosystem in Pakistan. It ensure use of legal devices on the mobile networks. The import, use, and growth of legal devices will improve the quality of mobile service to consumers, preserve network resources of the mobile operators, provide better security and ensure the protection of intellectual property rights.

Through this service, PTA makes sure that only type approved and legal devices are operational over mobile networks in the country.

Taxes/Duties Calculator

For the latest updates on taxes and duties applicable to mobile devices, people are required to visit the official FBR website: FBR Mobile Devices Regularization (https://www.fbr.gov.pk/mobile-devices…/51149/131261).

On this online portal, you will click an option “Mobile Device Duty Information” that will take you to the new page. Here, you will enter the IMEI number of the device and hit “Search” button to get details about applicable duty/taxes.

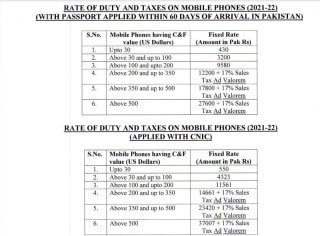

Calculate Rate of Duty/Taxes on Mobile Phones

You can also calculate the duty/taxes applicable to mobile phones by reading the following table issued by the FBR: