ZUBAIR YAQOOB

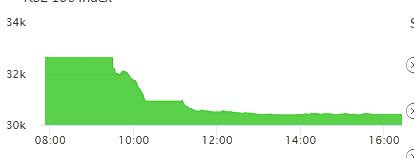

KARACHI Market witnessed the 8th halt on Wednesday which occurred at 12:20 PM when the market was trading – 1270pts having realized volumes of 71.4M shares. The market opened on a positive note with +100pts and 4.35M shares, which was primarily the result of relief package announced by the Prime Minister last evening. The eventual decline in the index is explained by the non-decision of the Govt. on the fate of market related relaxation which the Industry looked forward to, on account of Capital Gains Tax (CGT) or similar such relief. Overall, the benchmark index slid by 1396pts and closed the session -1336pts (unadjusted). Most of the volume was realized by Cement sector with 34.2M shares, followed by Banks (21.8M) and Power (18.1M). Among scrips, MLCF topped the charts with 14.4M shares, followed by KEL (11.6M) and BOP (7.9M). The Index closed at 27,229pts as against 28,564pts showing a decline of 1336pts (-5% DoD). Sectors contributing to the performance include Banks (- 430pts), Cement (-149pts), E&P (-132pts), Fertilizer (- 108pts) and Power (-100pts). Volumes increased from 98.8mn shares to 145.1mn shares (+47% DoD). Average traded value also improved by 121% to reach US$ 34.0mn as against US$ 15.6mn. Stocks that contributed significantly to the volumes include MLCF, KEL, BOP, UNITY and FCCL, which formed 33% of total volumes. Stocks that contributed positively to the index include FFC (+40pts), POL (+24pts), MUREB (+10pts), KEL (+8pts) and LOTCHEM (+4pts).