Shares at the Pakistan Stock Exchange (PSX) rose on Monday, with analysts attributing it to expectations of a deal with the International Monetary Fund (IMF) this week as well as the rupee’s recovery.

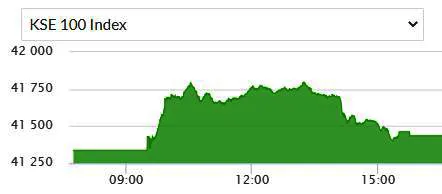

The benchmark KSE-100 index closed at 41,434.33 points, up 97.33 points or 0.24 per cent. It reached an intraday high of 460.71 points or 1.11 points around 1:15pm.

Intermarket Securities’ Head of Equity Raza Jafri said the rollover of a $1.3 billion loan by the Industrial and Commercial Bank of China Ltd would ensure that the central bank’s foreign exchange reserves, which are at a critically low level, continue to rise.

“This should pave the way for the successful resumption of the IMF programme, and this is resulting in equities continuing their bounce,” he commented.

Arif Habib Corporation Director Ahsan Mehanti attributed the KSE-100 index’s rise to the rupee’s strong recovery by Rs3.46 in the interbank market in anticipation of the IMF programme’s revival.

He added that speculations over likely restructuring of debt repayments after resumption of the IMF programme and the rollover of the $1.3bn loan played a catalyst role in the bullish activity.

Pakistan is in the midst of a severe economic crisis, with its reserves depleting to $3.8bn, not enough to cover even a month’s import bill. In such a situation, the country urgently needs to sign a deal with the IMF that would not only release $1.2bn but also unlock funding from friendly countries and other multilateral lenders.

The government is set to resume virtual talks with the IMF today to finalise revenue and expenditure figures for the next four months.

The IMF team, led by its Pakistan mission chief Nathan Porter, held talks with finance ministry officials for a couple of days, followed by a last meeting with tax officials on Friday to review the impact of prior actions in terms of revenue generation and their impact on bridging fiscal gaps.

Both sides will also fine-tune the language of a draft Memorandum of Economic and Fiscal Policies (MEFP), generally called the staff-level agreement, a government official had told Dawn, adding that the text of the agreement would be discussed in detail from Monday onwards.