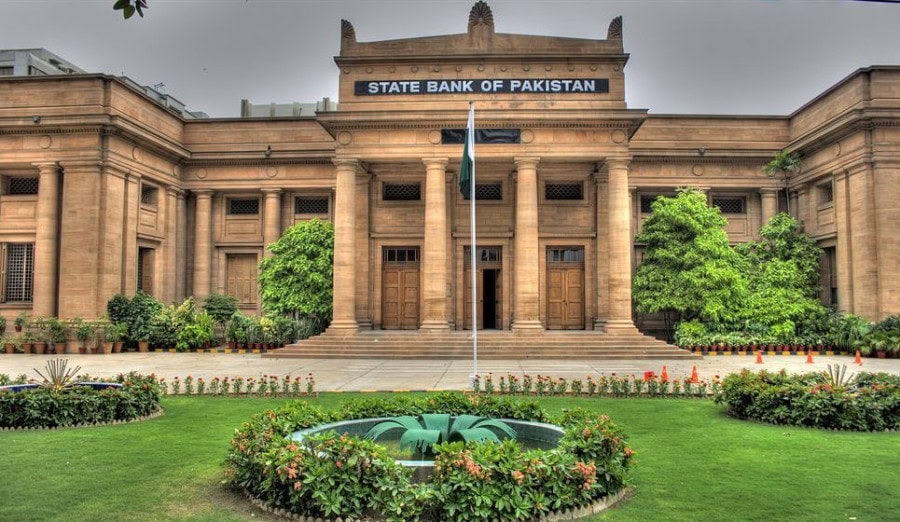

Karachi: The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) is scheduled to meet today (Monday) to decide the key policy rate for the next month and a half.

According to the central bank, Governor SBP Mr Jameel Ahmad will announce the monetary policy decision at a press conference after the MPC meeting.

The Monetary Policy Committee of #SBP will meet on Monday, January 23, 2023 to decide about Monetary Policy. Governor SBP Mr. Jameel Ahmad will announce the Monetary Policy decision at a press conference on the same day after MPC meeting.

— SBP (@StateBank_Pak) January 21, 2023

At the last meeting on November 25, the MPC raised the policy rate by 100 basis points to 16% as the “inflationary pressures” proved to be “stronger and more persistent than expected”.

The decision was taken to ensure that the elevated inflation does not become entrenched and that risks to financial stability are contained, thus paving the way for higher growth on a more sustainable basis.

Before November 25, the policy rate was kept at 15%, as decided in the meetings on July 7, August 22, and October 10, respectively.

It is important to know that the central bank has increased the rate by a cumulative 900 basis points in the last 15 months (September 2021 to November 2022) to 16%.