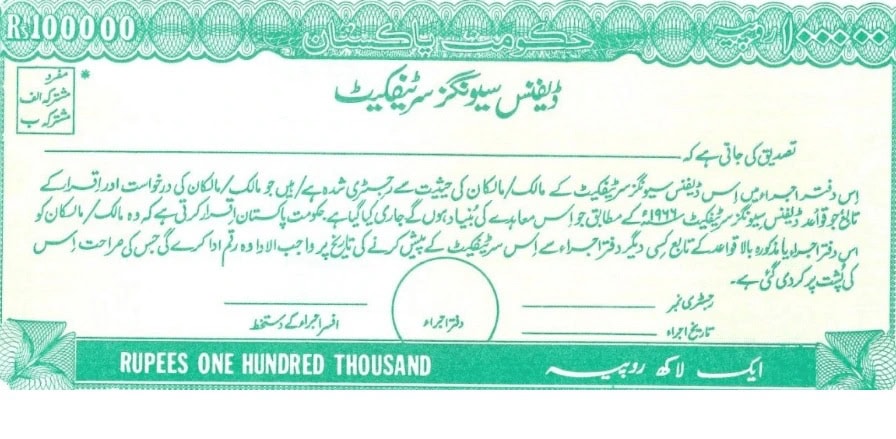

ISLAMABAD – Defence Savings Certificates (DSCs) scheme was launched by the Pakistani government decades ago to help long term investors cater their financial needs.

The Qaumi Bachat Bank or National Savings offers 10 years maturity plan so investors can enjoy maximum benefit or profit on their savings.

The National Savings or Qaumi Bachat Bank has announced new profit rate of various investment certificates, including DSCs, with effect from October 2024.

Who Can Invest in DSCs?

Both Pakistani nationals and overseas Pakistanis can invest in the Defence Savings Certificates. These certificates have a maturity period of 10 years and come in denominations of Rs.500, Rs.1,000, Rs.5,000, Rs.10,000, Rs.50,000, Rs.100,000, Rs.500,000, and Rs.1,000,000.

Defence Savings Certificates Profit from Oct 2024

The profit rate for Defence Savings Certificates has been reduced to 12.51 percent as previously it stood at 13.57% in Pakistan.

Defence Savings Certificates Tax/Zakat Deduction

The taxes and Zakat are deducted on the profits in line with the policy of the State Bank of Pakistan.

The withholding tax for filers has been fixed at 15 percent while it is 30 percent for non-fielders.