KARACHI – The Central Directorate of National Savings (CDNS) has once again revised the rates of return on various schemes offered by the National Savings or Qaumi Bachat Bank.

The third downward revision in last two months saw a cut of up to 72 basic points. The profit rate of Defence Savings Certificates, according to official website, stands at 14.1%.

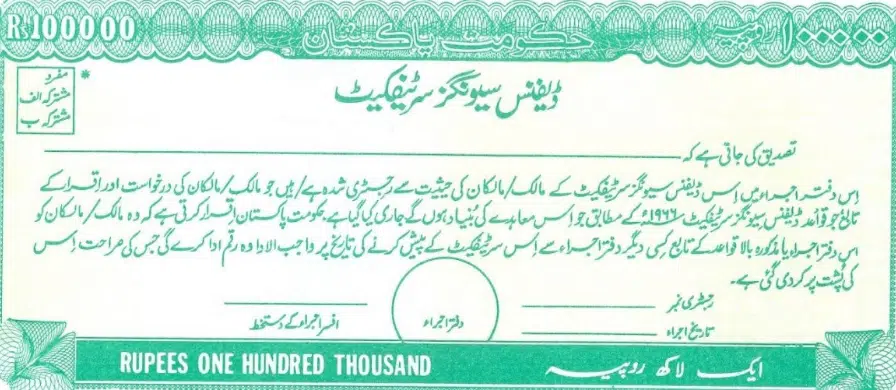

The Defence Certificates can be purchased by Pakistani nationals and overseas Pakistanis. These certificates have a maturity period of 10 years and come in denominations of Rs.500, Rs.1,000, Rs.5,000, Rs.10,000, Rs.50,000, Rs.100,000, Rs.500,000, and Rs.1,000,000.

To purchase a Defence Savings Certificate, customers can deposit cash, cheque, draft, or pay order at the Issuing Office. The certificates can be encashed at any time after the purchase date but no profit is payable if encashment is made before the completion of one year. Taxes are applicable on these certificates.

Defence Savings Certificates Profit Rate Feb 2024

The bank recently revised the profit rates of its different products, including Defence Savings Certificates. According to the latest update, the profit rate for Defence Savings Certificates stands at 14.1%.

Payable Amount (Principal + Profit ) On Investment of Every Rs.100,000

First year Rs112,000

2 Years Rs125,000

3 years Rs139,000

4 years Rs155,000

5 Years Rs175,000

6 Years Rs200,000

7 Years Rs230,000

8 Years Rs265,000

9 Years Rs308,000

10 Years Rs360,000

Defence Savings Certificates Tax/Zakat Deduction

The rate of tax to be deducted shall be as follows:

Filers: Persons appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 15% of the yield/profit irrespective of date of investment and amount/profit.

Non-Filers: Persons not appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 30% of the yield/profit irrespective of date of investment and amount/profit.