Zubair Yaqoob

Karachi

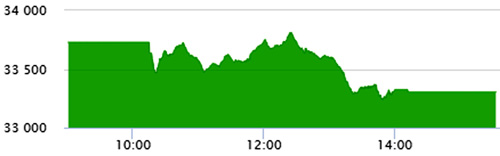

Market opened on a negative note on Thursday and could only manage to pull back into green for a brief time, before plunging due to selling pressure. Regardless of what the international crude prices are trading at, local E&P and O&GMCs which responded positively to the ascend in international crude prices last week, remained oblivious to further price gains.

Profit booking is clearly on investors mind, who have so far been cashing out from Fertilizer, Cement, E&P and O&GMCs. Banks, on the other hand, which have weathered the flow from foreign investors (possibly due to MSCI rebalancing), showed initial signs of recovery on the prospect of expectation of status quo in the upcoming monetary policy.

This is reflected by the yield change in secondary market for 10yr PIBs, which marked a low of 7.64% on April 17, 2020 and have since then recovered to 8.23% today, indicating that there may be a status quo on policy rate.

Cement sector led the volumes with 41.8M shares, followed by Banks (19.1M) and O&GMCs (18.9M). Among scrips, HASCOL topped with 16.1M shares, followed by MLCF (12.6M) and DGKC (8.2M). The Index closed at 33,304pts as against 33,728pts showing a decline of 424pts (-1.3% DoD). Sectors contributing to the performance include E&P (-127pts), Cement (-56pts), Power (-54pts), Fertilizer (-41pts) and O&GMCs (-39pts).