Alot of Pakistanis invest in Central Directorate of National Savings (CDNS) due to schemes’ safety, stable returns, and variety of products tailored to different needs, including specialized schemes for senior citizens and marginalized groups.

National Savings have long served as primary channel for savings in Asian nation through government securities. With a mammoth portfolio valued at Rs 3.2 trillion, National Savings accounts for about 14 percent of country’s total banking deposits and serves around 30 lac customers.

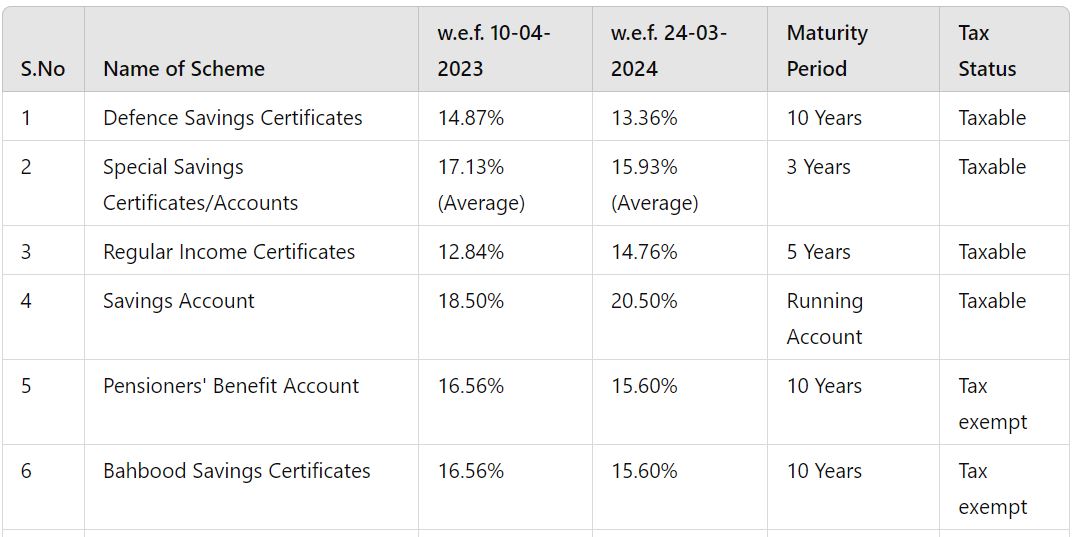

National Savings Scheme Profit Rates 2024

| S.No | Name of Scheme | w.e.f. 10-04-2023 | w.e.f. 24-03-2024 | Maturity Period | Tax Status |

| 1 | Defence Savings Certificates | 14.87% | 13.36% | 10 Years | Taxable |

| 2 | Special Savings Certificates/Accounts | 17.13% (Average) | 15.93% (Average) | 3 Years | Taxable |

| 3 | Regular Income Certificates | 12.84% | 14.76% | 5 Years | Taxable |

| 4 | Savings Account | 18.50% | 20.50% | Running Account | Taxable |

| 5 | Pensioners’ Benefit Account | 16.56% | 15.60% | 10 Years | Tax exempt |

| 6 | Bahbood Savings Certificates | 16.56% | 15.60% | 10 Years | Tax exempt |

| 7 | Shuhada Family Welfare Account | 16.56% | 15.60% | 10 Years | Tax exempt |

| 8 | National Prize Bonds (Bearer) | 10.00% | 10.00% | Perpetual | Taxable |

| 9 | Premium Prize Bonds (Registered) | 12.92%** | 16.40%* | Perpetual | Taxable |

| 10 | Short Term Savings Certificates (STSC) | ||||

| STSC 3 Months | 19.92% | 19.40% | 3 Months | Taxable | |

| STSC 6 Months | 19.64% | 19.38% | 6 Months | Taxable | |

| STSC 12 Months | 19.82% | 19.00% | 12 Months | Taxable | |

| 11 | SARWA Islamic Savings Schemes | ||||

| SISA | – | 20.50% | Running Account | Taxable | |

| SITA 1 Year | – | 18.54% | 1 Year | Taxable | |

| SITA 3 Year | – | 15.25% | 3 Year | Taxable | |

| SITA 5 Year | – | 14.76% | 5 Year | Taxable |

CDNS aims to offer a financial safety net to the general public, particularly senior citizens, pensioners, widows, differently-abled individuals, and the families of martyrs from the war against terror. It accomplishes this by maintaining a diverse product mix of NSS to meet various customer needs.

Along with other products, directorate came up with two new products, SARWA Islamic Savings Schemes, a Shariah-compliant option, and digital savings schemes, with a combined net investment of Rs 78.0 billion.

NSS product range includes options from 3-month Short-Term Savings Certificates (STSC) to 10-year long-term Defence Savings Certificates.