Zubair Yaqoob

Karachi

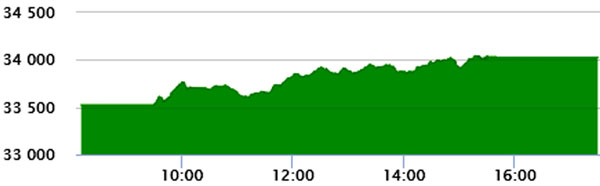

Market rebounded on Thursday with a jump of 500pts that took the index above 34k level, last seen in early July 2019. Activity was observed across the board, but mainly contributed by Banking and Cement sectors. Expectation of further increase in Cement price / bag gave way to optimism in Cements, while improvement in fixed income portfolio for the Banks also engaged Investors. Volumes improved over the day to 261M shares and was mainly contributed by Chemical sector, which performed consecutively to reach a turnover of 49.4M shares, followed by Cement (30.3M) and Banks (23.9M). Among scrips, LOTCHEM realized volume of 26.5M shares, followed by PIBTL (17.2M) and KEL (16.4M). The Index closed at 34,028pts as against 33,524pts showing an increase of +504pts (+1.5% DoD). Sectors contributing to the performance include Banks (+115pts), E&P (+74pts), Cement (+58pts), Power (+40pts) and Tobacco (+31pts).

Volumes increased from 237.7mn shares to 261.1mn shares (+10% DoD). Average traded value also increased by 32% to reach US$ 54mn as against U$ 40.9mn. Stocks that contributed significantly to the volumes include LOTCHEM, PIBTL, KEL, UNITY and EPCL, which formed 33% of total volumes.

Stocks that contributed positively include LUCK (+41pts), UBL (+32pts), HBL (+31pts), PAKT (+31pts) and HUBC (+30pts). Stocks that contributed negatively include BAFL (-13pts), EFERT (-7pts), JLICL (-5pts), PPL (-3pts), and IGIHL (-2pts).