Rafia Ashar

In an era marked by the perpetual evolution of global finance, the concept of ‘de-dollarization’ is gaining prominence. This term refers to countries diversifying their financial reserves and reducing their reliance on the US Dollar (USD). Pursuing monetary sovereignty, concerns about the USD’s stability, and the aggressive ‘weaponisation’ of the USD are some factors driving this trend. The USD, the dominant world currency since the 1944 Bretton Woods Agreement, is the primary currency used by International Financial Institutions (IFIs) to fund developing nations.

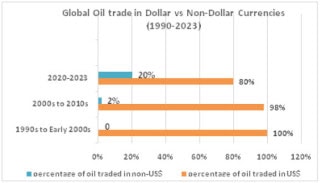

However, the de-dollarisation drive gained momentum with the revival of the Russian economy and the rise of China with new alternative currencies like the Chinese Yuan and the Russian Ruble. The governments of China and Russia, which have been working to lessen their reliance on the USD for the past ten years, have increased their cooperation by fostering collaboration between their financial systems, as shown in Graph 1. This effort was recently highlighted at the St. Petersburg International Economic Forum (SPIEF), a significant global economic event in Russia, where 132 countries worldwide, including BRICS nations, also aimed to create a financial independent payment system and use national currencies in international trade.

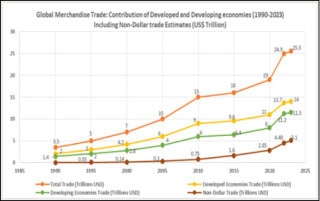

In this regard, several countries and regional trade organisations have adopted different de-dollarisation models, driven by the desire to reduce reliance on USD. China, Russia, India, Southeast Asian countries, African countries, and large trade organisations such as BRICS, ASEAN, and SCO are some key players.

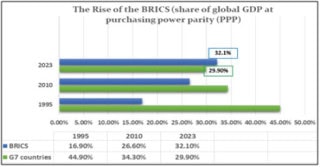

Regarding trade and reserve holdings, the BRICS forum has been at the forefront of de-dollarization efforts. By creating currency swap agreements, promoting trade in local currencies and & investigating alternative settlement systems, these countries have made significant progress towards reducing their reliance on USD. The graph 2 shows that the total GDP of BRICS has surpassed the economically influential group of G7 countries.

At a global level, de-dollarization has the prospect of disrupting and destabilising current financial systems. It can weaken USD dominance and transfer it to currencies such as the Euro, Chinese Yuan, or even a basket of currencies. It could challenge the US’s ability to impose sanctions, as countries might circumvent US-controlled financial channels and trade using alternative currencies. De-dollarization can stabilise regional currencies at the regional level depending on trade and connectivity between regional countries. Local currencies will face less pressure as alternative payment methods become more widely accepted and advanced.

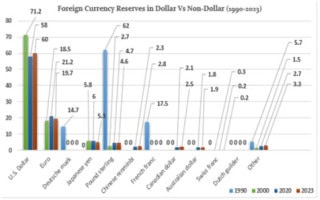

Despite the rising momentum, de-dollarization faces several challenges. The first key factor is the lack of viable alternatives to the USD. Although the Chinese Yuan (Renminbi) has been categorised as a possible rival, there are still several obstacles to internationalisation, and it is not yet entirely convertible. The USD dominance provides global markets liquidity and stability; hence, financial markets could become less predictable if there is a shift away from the USD due to greater currency volatility and decreased liquidity. Particularly for commodities like oil, the USD is frequently utilised as the base currency for international trade invoicing and pricing, as shown in Graph 3.

Despite the rising momentum, de-dollarization faces several challenges. The first key factor is the lack of viable alternatives to the USD. Although the Chinese Yuan (Renminbi) has been categorised as a possible rival, there are still several obstacles to internationalisation, and it is not yet entirely convertible. The USD dominance provides global markets liquidity and stability; hence, financial markets could become less predictable if there is a shift away from the USD due to greater currency volatility and decreased liquidity. Particularly for commodities like oil, the USD is frequently utilised as the base currency for international trade invoicing and pricing, as shown in Graph 3.

The global reserve currency composition is almost 60%, as shown in graph 4. This graph also indicates the level of USD integration in the global market share compared to alternative currencies, which only make up 40%. Lastly, the shift from the USD faces challenges due to divergent economic agendas, geopolitical interests, and a varied state of development. The strength and reliability of USD are trusted by foreign companies, investors, and people, necessitating the establishment of trust in new systems to encourage currency conversion.

In the case of Pakistan, de-dollarization has several economic, geopolitical, and strategic outcomes. It allows Pakistan to engage more actively with neighbouring countries like China, Afghanistan and Iran by reducing its dependency on USD and trading in Yuan, specifically under the China-Pakistan Economic Corridor framework or entering into currency swap settlements to facilitate trade in local currencies. Moreover, diversifying foreign exchange reserves allows Pakistan to include Euro, Yuan, Yen, and other currencies rather than relying on USD. In addition, developing onshore financial markets to support the trade in local currencies also decreases the necessity for dollar-denominated debt.

On the other hand, regional de-dollarization efforts could also bring significant benefits to Pakistan. For instance, China’s central bank is working on a digital currency initiative and is seeking signatories from different countries. If oil-producing nations join this initiative, it could revolutionise global finance. For Pakistan, becoming a signatory could provide access to Chinese Financial Markets, enabling low-cost commercial borrowing in yuan and stimulating investment prospects. Moreover, the Gawadar legislation, which mandates all companies operating within its trading zones to conduct transactions in the local currency, presents a significant opportunity for Pakistan, aligning with broader regional de-dollarization trends.

On the other hand, regional de-dollarization efforts could also bring significant benefits to Pakistan. For instance, China’s central bank is working on a digital currency initiative and is seeking signatories from different countries. If oil-producing nations join this initiative, it could revolutionise global finance. For Pakistan, becoming a signatory could provide access to Chinese Financial Markets, enabling low-cost commercial borrowing in yuan and stimulating investment prospects. Moreover, the Gawadar legislation, which mandates all companies operating within its trading zones to conduct transactions in the local currency, presents a significant opportunity for Pakistan, aligning with broader regional de-dollarization trends.

Besides this, de-dollarization can increase Pakistan’s vulnerability to US sanctions, and it might strain Pakistan’s diplomatic relations with the US, potentially impacting foreign aid, trade and military assistance that currently benefits Pakistan. Moreover, Pakistan’s economic stability could be at risk during the transition period as USD is deeply entrenched in global financial systems, and moving away from it might lead to volatility in exchange rates and financial markets, given that the vast majority of international trade from the 1990s to 2023 has been conducted in USD compared to non-dollar currencies as shown in the graph 5.

De-dollarization presents both opportunities and challenges for the global economy and Pakistan. The diversification of monetary reserves and the pursuit of non-dollar alternatives by nations have left the future of the international financial system uncertain. For Pakistan, joining BRICS will offer significant advantages as a new economic world order emerges, marking a shift away from reliance on the traditional USD-dominated system. The ‘Dawn of the Asian Century’ offers new opportunities, with Asia primed to create an alternate financial order. Aligning with BRICS offers Pakistan a strategic pivot by leveraging its geoeconomic and geostrategic position to better integrate with the emerging world order. However, this shift necessitates realigning current security and economic policies, which are traditionally oriented towards a Western-led financial framework. Additionally, regional economic integration within the ECO (Economic Cooperation Organization) region in local currencies is another highly constructive aspect for Pakistan, as it enhances trade affairs and strengthens regional ties, contributing to a more robust and diversified economic landscape.—Email:[email protected]

De-dollarization presents both opportunities and challenges for the global economy and Pakistan. The diversification of monetary reserves and the pursuit of non-dollar alternatives by nations have left the future of the international financial system uncertain. For Pakistan, joining BRICS will offer significant advantages as a new economic world order emerges, marking a shift away from reliance on the traditional USD-dominated system. The ‘Dawn of the Asian Century’ offers new opportunities, with Asia primed to create an alternate financial order. Aligning with BRICS offers Pakistan a strategic pivot by leveraging its geoeconomic and geostrategic position to better integrate with the emerging world order. However, this shift necessitates realigning current security and economic policies, which are traditionally oriented towards a Western-led financial framework. Additionally, regional economic integration within the ECO (Economic Cooperation Organization) region in local currencies is another highly constructive aspect for Pakistan, as it enhances trade affairs and strengthens regional ties, contributing to a more robust and diversified economic landscape.—Email:[email protected]