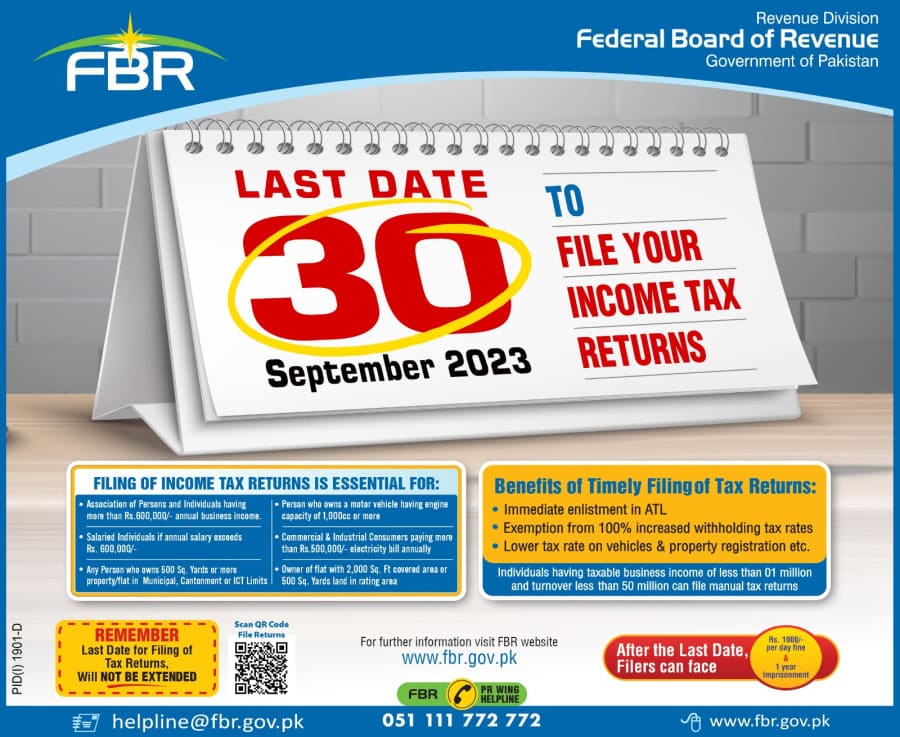

KARACHI – As the fiscal year comes to a close, the Federal Board of Revenue (FBR) urges taxpayers across Pakistan to meet their crucial tax filing deadline by September 30, 2023. This deadline applies to all categories of taxpayers, emphasizing the importance of timely tax compliance.

Key Highlights

- Universal Deadline: September 30th deadline applies to all taxpayers, promoting equal compliance opportunities for individuals, businesses, associations, and companies with special fiscal year arrangements.

- Avoid Penalties: Filing on time is a legal requirement to avoid penalties and legal complexities. Delays may incur fines imposed by the tax authorities.

- Access to Benefits: Timely filing ensures inclusion in the Active Taxpayers List (ATL), granting reduced tax rates and specific privileges to taxpayers.

- E-filing Convenience: FBR offers an electronic filing option for a streamlined process, enhancing ease and efficiency for taxpayers to meet the deadline.

- Professional Assistance: Taxpayers seeking support with tax return preparation can engage tax professionals or consultants to ensure accurate and timely submissions.

- Plan Ahead: Prepare by gathering necessary documents and financial information to complete your income tax return accurately, ensuring a smooth submission process.

Benefits of Tax Filing:

- Documentation of Income: Tax filing serves as an official record of your income. This can be valuable when you need to prove your income for various purposes, such as applying for visas, loans, or scholarships.

- Tax Refunds: If you’ve paid more taxes than you owe, filing a tax return allows you to claim a refund. This can help you recover any excess taxes withheld from your income.

- Compliance with Visa Requirements: Some countries, when issuing visas, require applicants to provide proof of their tax-filing history. Being a tax filer can make it easier to meet these requirements.

- Fulfilling National Responsibilities: Paying taxes is a way of contributing to the development of the country and supporting public services like healthcare, education, and infrastructure.

- Avoiding Penalties: Failure to file taxes or underreporting income can result in penalties, fines, or even legal consequences. Filing your taxes on time can help you avoid these issues.

- Business Benefits: For businesses, being a tax filer is essential for conducting business transactions, obtaining government contracts, and maintaining a good reputation in the business community.

- Applying for Government Tenders: If you’re a business, being a tax filer is often a requirement for participating in government tenders and contracts.