Zubair Yaqoob

Karachi

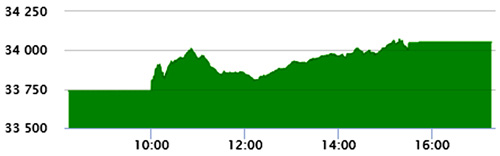

Market followed the momentum made on Monday and increased another 335pts during the session, closing +309pts (unadjusted). Traded volume remained thin as have been the case in the past couple of sessions, mainly due to financial year end marked to market valuation of portfolio scrips by institutional investors. Among E&P Stocks, OGDC came in limelight with price gains, which was aided by an upward move in international crude oil prices. Similarly, PSO also witnessed price gains during the session. Banking sector stocks also traded largely in the positive territory. Technology sector stocks topped the volumes with 20.9M shares, followed by Cement (15.5M) and Chemical (14.2M). Among scrips, TRG led the volumes with 11.8M shares, followed by UNITY (11M) and MLCF (6.9M). The Index closed at 34,053pts as against 33,738pts showing an increase of +315pts (+0.9% DoD). Sectors contributing to the performance include E&P (+68pts), Cement (+38pts), O&GMCs (+35pts), Power (+29pts) and Banks (+27pts). Volumes declined from 161.2mn shares to 160.6mn shares (-0.8% DoD). Average traded value also declined by 9% to reach US$ 33.5mn as against US$ 36.5mn. Stocks that contributed significantly to the volumes include TRG, UNITY, MLCF, PAEL and PRLR1, which formed 26% of total volumes.