Zubair Yaqoob

Karachi

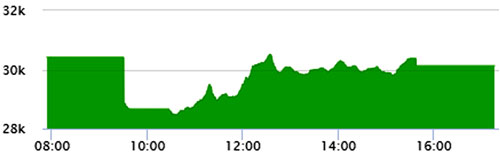

Market witnessed the 6th halt on Thursday when the benchmark KSE100 index dropped 1562pts, having traded 8.5M shares. Overall, the index lost 1964pts during the session, reaching 28,452pts, and rebounded to erase all the losses and trading 100pts green for a while, only to resume selling later on. The index closed 286pts down from LDCP. Buying activity was largely observed in Fertilizer, Banking and Oil & Gas sector.

Cement sector also saw buying activity initially which brought the cement sector scrips from lower lock to tradable range, however, selling activity brought these stocks back to lower circuits. Cement sector led the volumes with 48.8M shares, followed by Banks (43.3M) and Power (36.9M). Among scrips, KEL topped the volumes with 22.1M, followed by UNITY (19.3M) and BOP (18.8M).

The Index closed at 30,130pts as against 30,416pts showing a decline of 286pts (-0.9% DoD). Sectors contributing to the performance include Cement (-179pts), Power (-104pts), O&GMCs (-55pts), Textile (-53pts), Food (-48pts), Fertilizer (215pts), Banks (115pts).

Volumes increased from 186.6mn shares to 308.3mn shares (+65% DoD). Average traded value also increased by 90% to reach US$ 63.8mn as against US$ 33.5mn. Stocks that contributed significantly to the volumes include KEL, UNITY, BOP, FCCL and MLCF, which formed 30% of total volumes. Stocks that contributed positively to the index include FFC (+91pts), ENGRO (+81pts), MCB (+66pts), BAHL (+52pts) and EFERT (+46pts). Stocks that contributed negatively include HUBC (-95pts), LUCK (-85pts), UBL (-65pts), NESTLE (-50pts), and DGKC (-26pts).