Staff Reporter Islamabad

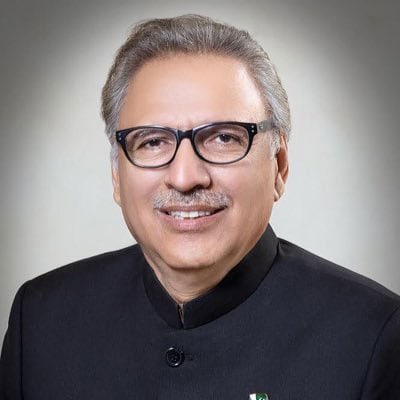

President Arif Alvi has promulgated new tax laws, empowering the authorities to disconnect mobile phones/SIMS, electricity and gas connections of persons who are required to file tax returns but fail to appear on the Active Taxpayer List (ATL).

The president promulgated the Tax Laws (Third Amendment) Ordinance 2021 for allowing the Federal Board of Revenue to share its data with the National Database and Registration Authority with the objective to broaden the tax net.

The NADRA shall share its records and any information available or held by it with the Board, as per the ordinance.

The ordinance contains strict penalties for persons who do not file tax returns. A penalty of Rs 1,000 per day of default has been included in the Ordinance.

The government has also increased the amount of penalty for tier-1 retailers who are not integrated with the FBR and imposed an additional advance tax on rates ranging from 5% to 35% on professionals using domestic electricity connections.

The Ordinance identifies professionals as accountants, lawyers, doctors, dentists, health professionals, engineers, architects, IT professionals, tutors, trainers, and other persons engaged in the provision of services.

The government has granted sales tax zero-rating to fat-filled milk including those sold in retail packing under a brand name or a trademark.

Under the Ordinance, the reduced rate of 16% sales tax would be applicable on supplies made by POS integrated outlets where payment is made through the digital mode; reduced rate of 14% on meltable scrap imported by steel melters; a reduced rate of 5% on import of electric vehicles on Completely Built Up condition and reduced rate of 16.9% sales tax on business-to-business transactions, where payment is made through the digital mode.

Moreover, the government has excluded steel and edible oil sectors from the charge of further tax.

Through the new Ordinance, the FBR has given legal cover to foreign remittances received through foreign currency accounts of Overseas Money Service Bureaus, Exchange Companies, and Money Transfer Operators for granting income tax exemption under Section 111(4) of the Income Tax Ordinance, 2001.