Zubair Yaqoob

Karachi

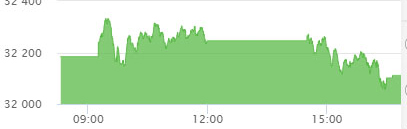

The benchmark KSE100 index commenced on a positive note this week led by the E&P sector on the back of surge in oil prices following the strike on 2 major Saudi oil facilities. Monday also saw the MPS where the SBP decided to leave the policy rate unchanged at 13.25%. This week also saw a PIB auction in which cut-off yields continued to witness attrition (3-Yr: -130bps, 5-Yr: -105bps, 10-Yr: -90bps) while the yield curve continued to exhibit an inverted shape. The reduction in yields stimulated positivity amongst investors (decline in yields create expectations of a rate cut) which was further cemented by positive statements from the visiting IMF Middle East & Central Asia Director. Moreover, CAD (Current Account Deficit) for the month of August depicted a 9.4% MoM decline while 2MFY20 CAD showed a 55% YoY reduction. The index closed at 32,111pts (+630pts WoW). Sector-wise positive contributions came from i) Oil & Gas Exploration Companies (204pts), ii) Commercial Banks (147pts), iii) Fertilizers (98pts), iv) Oil & Gas Marketing Companies (89pts), and v) Pharmaceuticals (56pts). Scrip-wise positive contributions were led by PPL (99pts), HBL (77pts), UBL (72pts), OGDC (63pts) and ENGRO (57pts). Foreign buying was witnessed this week clocking-in at USD 7.75mn compared to a net buy of USD 1.01mn last week. Buying was witnessed in Commercial Banks (USD 3.6mn) and Cement (USD 2.0mn). On the domestic front, major selling was reported by Insurance Companies (USD 9.0mn) and Mutual Funds USD 6.8mn. Average Volumes settled at 123mn shares (down by 5% WoW) while average value traded clocked-in at USD 33mn (down by 13% WoW). Other major news, Current account deficit declines by 55pc in first 2 months of FY2020, FDI drops 58.4 percent to $156.7 million in July-August, IMF programme off to good start, cannot be revised after only 3 months State Bank holds benchmark interest rate at 13.25%, and PTI govt eyes Rs1tr non-tax revenue next year. Analysts expect the positive momentum to continue next week on the back of improving macro-economic situation. Reduction in PIB yields have once again made equities an attractive asset class and with valuations at dirt cheap levels, we can expect the inflection in sentiment to continue. The rejuvenation of foreign interest in the market is also a major factor that should continue to fuel the positivity.