What is a Roshan Digital Account?

Roshan Digital Account is a major ambition of the State Bank of Pakistan, in partnership with commercial banks operating in Pakistan. These accounts give innovative banking solutions for millions of Non-Resident Pakistanis (NRPs) exploring to undertake banking, payment and investment activities in Pakistan.

The Roshan Digital Account (RDA) is a tailor-made financial solution, created to facilitate Non-Resident Pakistanis in their strategies for investment in Pakistan based Savings Schemes and is fitting for both PKR and USD based transactions.

To further facilitate our Non-Resident Pakistani customers, Banks are also introducing a Digital Account Opening process through which you can apply for a new Roshan Digital Account with convenience and ease. With minimal documentation conditions and an easy to use interface, you can access the new web service from the various commercial banks in Pakistan to securely open an RDA from the safety and convenience of your home.

Convenient Digital Account Opening and Operation:

A remarkable achievement in Pakistan’s history, NRPs are being provided with an opportunity to remotely open an account in Pakistan by an entirely digital and online process without any need to visit a bank branch. Opening the account will require only a basic set of information and documents. Banks have been asked to complete all necessary customer due diligence within 48 hours.

The Roshan Digital Account fully blends the Pakistani environment with Pakistan’s banking and payment system by:

- Providing digital access to all conventional account services including funds transfer, bills and fee payments, and e-commerce.

- Enabling investment by Non-resident Pakistanis in Naya Pakistan Certificates (NPCs) issued by the Government of Pakistan, in both PKR and USD, at very persuading risk-free rates and in both traditional and Shariah-compliant forms. (Click for GoP Notification).

- On NPC, only a 10% withholding tax on profits is applicable that is full and final. No filling of tax return is needed. Resident Pakistanis who have listed assets abroad with FBR can also invest in USD-denominated NPCs. To do so, they can open a Roshan Digital Account in foreign currency by visiting a bank branch in Pakistan. (Click here for details)

- Enabling investment in Pakistan’s stock market.

- Opening up investment possibilities in the Pakistani property market including both commercial and residential real estate.

How to apply for a Roshan Digital Account | Habib Bank Limited

According to HBL’s online platform, the following services have been listed in an official featurette:

- No minimum balance requirement

- No service charges applicable

- Customer can open a Foreign Currency Value Account (USD) or an NRP Rupee Value Account*

- Both these accounts are fully repatriable

- The account can be fed by Foreign Inward Remittances originating from the account holder himself/herself through formal channels

- Monthly account statements sent to the registered email address

- Account to be opened by Non-Resident Pakistanis only

- Account to be operated singly

- Accounts are funded through foreign remittance only

- Local credits allowed to the extent of proceeds received from permissible investments made from the account

- Account to be opened in 48 hours if everything is in order

For filling the basic HBL Information form, click here to view and submit accordingly. After you have submitted your application, a bank official will contact you within 2 working days. Here on out, you’ll be guided through the account opening process.

Once the prior procedure is complete, send the required documents to ebanc.roshanaccount@hbl.com.

MCB Roshan Digital Account | Muslim Commercial Bank

According to MCB’s official site, the Roshan Digital Account offers you a multitude of benefits. These include perks such as no minimum balance requirements and the ability to repatriate your funds. The salient aspects of the new account reveal the following:

Product Types:

- Roshan Digital Account – PKR

- Roshan Digital Account – FCY

Product Attributes:

- All Non-Resident Pakistanis are eligible

- Available in Pak Rupee (PKR) and US Dollar (USD)

- Funded through foreign inward remittance

- Digital On-boarding with minimum documentation

Features:

- Easy repatriation of funds to customer’s foreign account

- No minimum balance requirement

- Online Banking for Bill Payments and Funds Transfers within Pakistan

- Investment in Naya Pakistan Certificate issued by Government of Pakistan (please click here for details)

- Supervised Investment in PSX registered shares through Central Depository Company (CDC)

- Lastly, Investment in Term Deposits of the Bank

Please visit this link to go through MCB’s secure application process.

For further information and due-diligence, please contact at 1110 00622.

RDA to Non-Resident Pakistanis (NRPs) | Bank Alfalah

Bank Alfalah offers Roshan Digital Account to Non-Resident Pakistanis (NRPs) residing across the world. According to their official digital services guideline, the following information has been disclosed to the general public:

Features

Before landing on the main application page, the portal presents you with the following options.

- Offered in two currencies: PKR and USD

- No minimum balance requirement

- The account can be fed by Foreign Inward Remittances only originating from the account holder through home remittances or SWIFT.

- Multiple investment opportunities: Naya Pakistan Certificate, access to stock market, etc.

- Easy repatriation of funds

- Free Debit Card

- Free SMS alerts

- Funds Transfer Facility

- Utility Bill Payment

- 24/7 Internet Banking

- Free E-Statements

Eligibility Criteria

The product will be offered to individuals above the age of 18, who are:

- Non-Resident Pakistanis

- Foreign Nationals having Pakistan Origin Card (POC)

- Employees or officials of the Federal Government or a Provincial Government posted abroad

- Resident individuals having declared their assets held abroad, as per wealth statement declared in the latest tax return with FBR

Required Documents

- Scanned Copy of Your CNIC/NICOP/POC

- Scanned copy of Your Passport (first 2 pages, Pakistani and/or foreign/another country, latest exit stamp on Pakistani Passport)

- Photograph (Passport size)

- Live photo

- Signature (scanned on a white page)

- Scanned copies of Overseas Pakistani Foundation (OPF) Card (if applicable)

- Proof of NRP Status (scanned copy of POC, visa, entry/ exit stamps etc.)

- Proof of profession and Source of Income/Funds (scanned copy of job certificate, tax return, rent agreement, salary slips etc.)

For further information and due-diligence, please contact at +92 21 111 225 226.

For Overseas Pakistanis | Standard Chartered Bank

Using their global network to assist customers, Standard Chartered is offering the following features for a Roshan Digital Account:

Before landing on the main application page, the portal presents you with the following options.

- Current Account offered in USD & PKR denominations

- Offered in Conventional and Islamic variants

- The account can be operated singly or jointly

- Internet Banking is offered

- Allows full repatriation and convertibility

- These accounts can be used for investment in Government securities (as allowed by the State Bank of Pakistan). Term deposits, receipt of investment proceeds and profits, foreign remittance of investment proceeds, and settlement amounts are applicable.

- Can be funded through remittances only via the banking channel.

- In the case of dormancy, it can be made operative by fulfilling formalities at domestic as well as overseas branches, representative offices or banking subsidiaries of SCB.

Note: Cheque Book & ATM facilities are currently unavailable for this service until further notice. Please visit here to apply for a Roshan Digital Account with Standard Chartered Bank Pakistan.

For further information and due-diligence, please contact at (021) 111 002 002.

Digital OPS Account Opening | UBL

According to UBL’s official mandate for Digital Banking for overseas Pakistanis, please read the following instructions carefully:

Visit this site for initiating registration process.

- Click on ‘Apply for Roshan Digital Account’ and follow the simple steps to open a USD or PKR current account. Before landing on the main application page, the portal presents you with the following options. Select relevant options and continue with the steps:

- Once you have completed the form and submitted the documents, a UBL representative will get in touch with you within 48 hours.

- To manage your account and investments, you will receive an email with a link to access UBL Net-banking. Use the link to create a username and password to access and manage your account digitally.

- You can view your account details including balance by logging in to Net-banking.

- You can now invest in Stocks & Bonds as well for attractive returns. Log in to Net-banking, Click on NRP Services & start investing!

*Bonds Investment coming soon

Eligibility

- Individual Non-Resident Pakistani Nationals (NRPs) having CNIC/ SNIC/ NICOP;

- Foreign Nationals having Pakistan Origin Card (POC);

- Employees or officials of the Federal Government or a Provincial Government posted abroad.

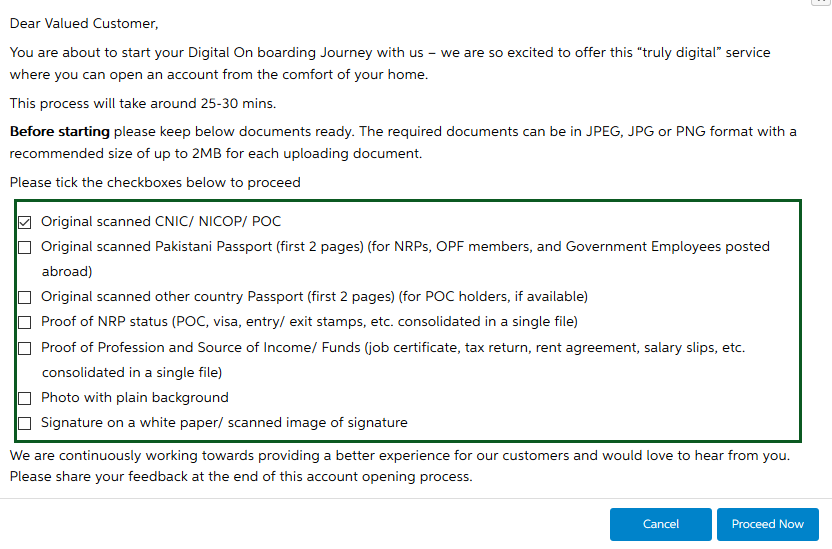

Required Documents

- Original scanned CNIC/ NICOP/ POC

- Original scanned Pakistani Passport (first 2 pages) (for NRPs, OPF members, and Government Employees posted abroad)

- Original scanned other country Passport (first 2 pages) (for POC holders, if available)

- Proof of NRP status (POC, visa, entry/ exit stamps, etc.)

- Proof of Profession and Source of Income/ Funds (job certificate, tax return, rent agreement, salary slips, etc.)

- Live /digital photo through Webcam

- Signature on white paper/ scanned image of signature

Please visit here to apply and register for a Roshan Digital Account with UBL.

For further information and due-diligence, please contact at +92 111 825 888

Meezan Roshan Digital Account | Meezan Bank

Account Opening:

- Easy repatriation of funds

- Opportunity to invest in Meezan Bank’s Mudarabah products

- No withholding tax (WHT) on cash withdrawals through Cheque or ATM

- No withholding tax (WHT) on non-cash transfers made during the tax year (July – June)

- The account can only be fed through home remittances, no other credits are allowed

- OTP secured digital/online account opening

- Account opening within 48 hours (subject to completion of all documentation/formalities)

Features:

- First Issuance: Free Checkbook

- Free Pay Order

- Free Internet Banking

- Online Branch Banking

- Zero restrictions on transactions

- Unlimited withdrawals and zero deductions

Meezan Roshan Digital Account is offered in both account types (current & savings) under the Islamic concept of Qard & Mudarabah.

To open a PKR account with Meezan Bank, visit this link and complete the form.

For registering and opening a USD account, visit this link and provide the required information.

For further information and due-diligence, please contact at +92 (21) 111-331–331 & +92 (21) 111-331–332.

This guide was about how to apply for Roshan Digital Account. If you have any questions, leave a comment in the section provided below. Stay tuned for more updates.