The system of cheque-clearance institution, the National Institutional Facilitation Technologies (NIFT) remains non-functional as cyber attackers managed to breach its security and force the banking system to resort to a manual system despite the prevalence of digital technology.

Even after seven days since the cyberattack occurred last week, NIFT is still in the process of fully restoring its normal operations. Cheques are being cleared manually nationwide, and digital payment services remain halted.

Last Friday (June 16), the attack forced the national institution to shut down both its data centres in Islamabad and Karachi.

The private banks said their cheque-clearance operation is badly affected as they are going for manual clearance and due to staff shortage, it is taking more time for clearance of cheques, which were earlier being cleared in seconds through NIFT.

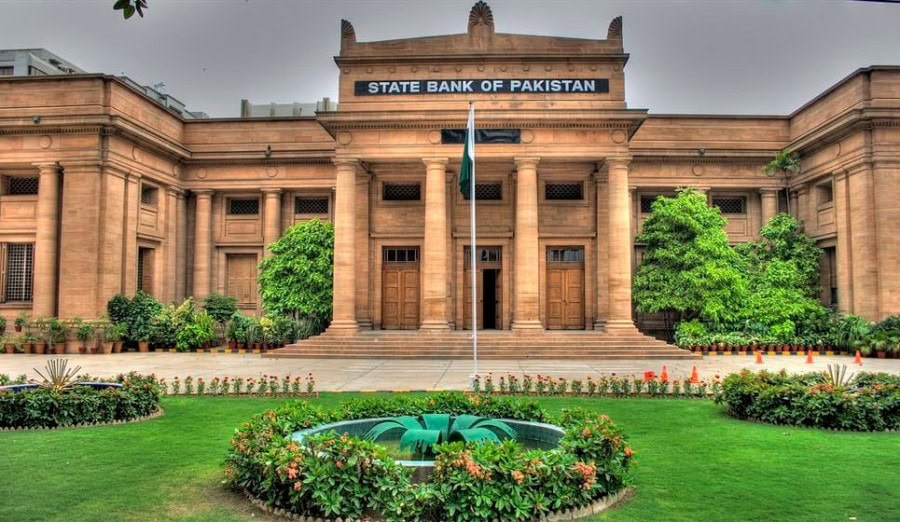

The State Bank of Pakistan (SBP) has sought an explanation from the NIFT.

Currently, Pakistani banks hold deposits worth around Rs23 trillion with 67.5 million bank accounts. NIFT processes nearly 150,000 to 160,000 cheques through its online system every day.