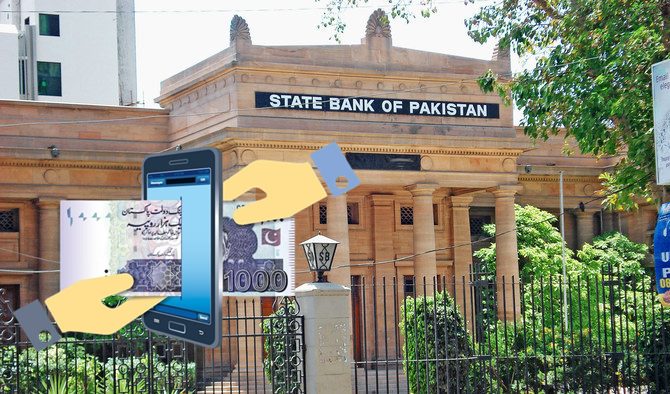

The State Bank of Pakistan (SBP) has granted In-Principle Approval (IPA) for establishing five digital retails banks in a bid to foster innovation, financial inclusion and availability of affordable digital financial services.

SBP has issued NOCs to HugoBank Limited, KT Bank Pakistan Limited, Mashreq Bank Pakistan Limited, Raqami Islamic Digital Bank Limited and Telenor Microfinance Bank Limited in January 2023.

After the fulfillment of the necessary requirements, these entities have now been granted in-principle approval to prepare themselves operationally to launch the digital financial services.

SBP Governor Jameel Ahmad awarded IPAs to the five proposed digital banks on Wednesday at a ceremony at SBP Museum Building in Karachi.

Sponsors of proposed DRBs, CEOs of incumbent banks, Payment System Operators (PSOs)/ Payment System Providers (PSPs), Electronic Money Institutions (EMIs), Fintechs and SBP’s top management attended the ceremony.

During his keynote address, SBP Governor highlighted the significance of the initiative of introducing DRBs in the country, its profound benefits to the financial system and some of the key challenges faced by such genre of financial players. He also mentioned a few other important regulatory initiatives in support of building a digital financial ecosystem and assured that SBP is fully committed to support various stakeholders for a bright, innovative, and digitally empowered future of banking in Pakistan.

Jameel assured the financial fraternity of SBPs commitment to make financial system more inclusive, more innovative, and more responsive to the needs of the citizens of Pakistan.

He also shared his expectations that post operational commencement, digital banks will help developing a digital eco-system, foster a new set of customer experience, provide affordable digital financial services including credit access to unserved and underserved segments of the society.

Earlier, Dr. Inayat Hussain, SBP Deputy Governor highlighted that these IPAs shall enable the proposed DRBs to proceed further with respect to achieving operational readiness in all their functions, including governance, risk management, capital requirements, compliance and audit, consumer protection, business continuity, cyber security, product development, deployment of technological infrastructure, formulation of relevant policies, processes & procedures.