ISLAMABAD – The profit rate on Short Term Savings Certificates of Qaumi Bachat Bank or National Savings Centre, stands was reduced, starting from August 2024.

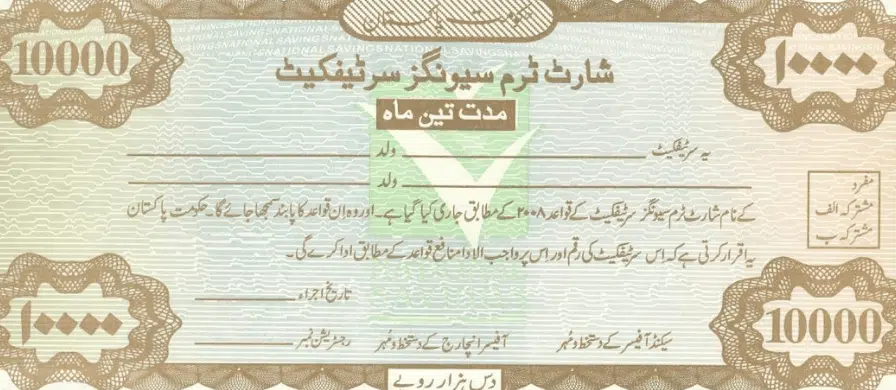

The government launched the Short Term Savings Certificates (STSCs) in July 2012 to meet the short term funding needs of the investors.

The maturity period for this investment ranges from three months, 6-months to on year. STSCs is pledge-able and having 3-month, 6-month and 1-year maturity scheme.

All Pakistani nationals as well as Overseas Pakistanis can purchase the certificates being a single adult, a minor or two adults jointly where the payments can be received either by the both jointly (Joint-A) or any one of the holders (Joint-B).

An investor can deposit minimum Rs10,000 in this category while there is no maximum limit.

Short Term Savings Certificates latest Profit Rate in August 2024

The news profit rate for Short Term Savings Certificates with three month maturity has been fixed at 19 percent after a decrease of 1.34%.

As of August 2024, the profit rate for six-month maturity category has been fixed at 18.92%. Similarly, the Qaumi Bachat Bank offers 17.9% profit on Short Term Savings Certificates with one year majority.

Tax Deduction on Profit Rate

The rate of tax to be deducted shall be as follows:

Filers: Persons appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 15% of the yield/profit irrespective of date of investment and amount/profit.

Non-Filers: Persons not appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 30% of the yield/profit irrespective of date of investment and amount/profit.

The investment made in STSCs will be exempted from collection of Zakat.