ISLAMABAD – If you are planning to invest you spare amount for a period of 10 year to earn reasonable profit, here is an attractive offer from National Savings Centre or Markaz Qaumi Bachat.

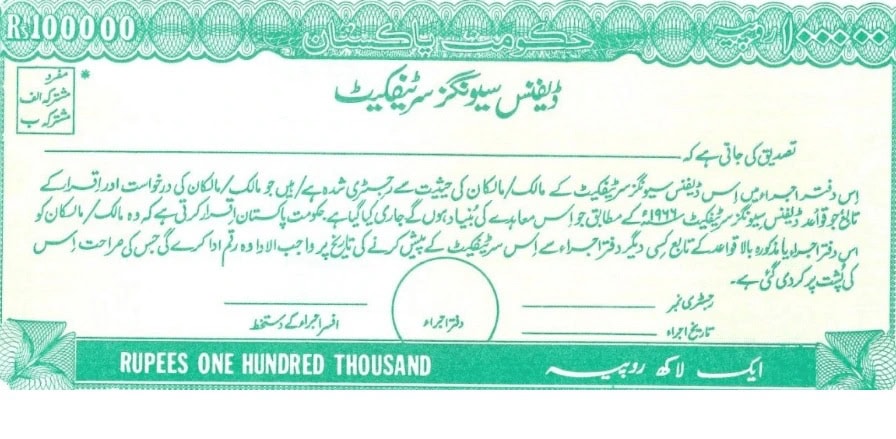

You can invest in Defence Savings Certificates, which can be bought by all Pakistani nationals as well as overseas Pakistanis. An adult can also purchase DSC on behalf of a single minor, two minors jointly or as a joint with a minor.

The certificates can be purchased from any National Savings Centre (NSC) by filling in the SC-I (Application Form) which available free of cost from all the above issuing offices.

A person can invest in this category with minimum Rs.500 while there is no maximum limit.

Defence Savings New Profit Rate

The Central Directorate of National Savings (CDNS) recently decreased the profit rate on January 31 and it came into effect from February 1. 2025.

In latest revision, it has reduced the profit rate by .09 percent, fixing the new rate at 12.10 percent. Following are the profits that a person can earn on investment Rs100,000 until 10 years maturity:

First Year Rs109,000

Second Year Rs119,000

Third Year Rs130,000

Fourth Year Rs143,000

Fifth Year Rs158,000

Sixth Year Rs177,000

Seventh Year Rs200,000

Eighth Year Rs229,000

Ninth Year Rs265,000

Tenth Year Rs310,000

The taxes and Zakat are deducted on the profits in line with the policy of the State Bank of Pakistan. The withholding tax for filers has been fixed at 15 percent while it is 30 percent for non-fielders.

Behbood Savings Certificates new profit rate in Pakistan from February 2025