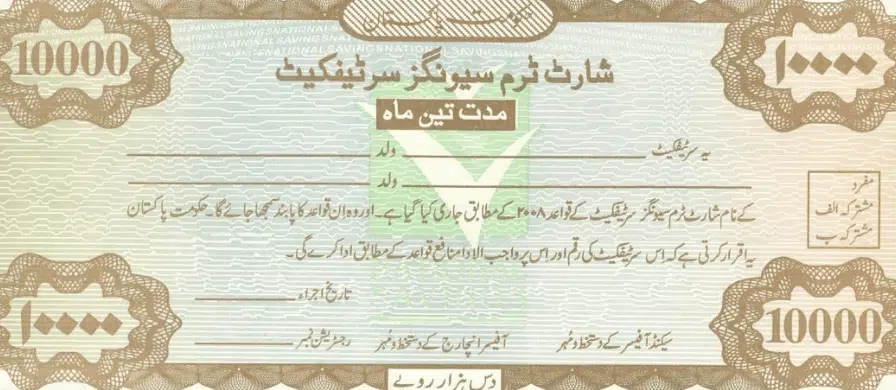

ISLAMABAD – Qaumi Bachat Bank or National Savings Centre introduced the Short Term Savings Certificates (STSCs) programme in July 2012 to meet the short term funding needs of the investors. The profit rate for these savings certificates were revised in January 2024.

The maturity period for this investment ranges from three months, 6-months to on year. STSCs is pledge-able and having 3-month, 6-month and 1-year maturity scheme.

All Pakistani nationals as well as Overseas Pakistanis can purchase the certificates being a single adult, a minor or two adults jointly where the payments can be received either by the both jointly (Joint-A) or any one of the holders (Joint-B).

An investor can deposit minimum Rs10,000 in this category while there is no maximum limit.

Short Term Savings Certificates Profit Rate 2024

The profit rate for Short Term Savings Certificates with three month maturity stands at 20.28 percent or Rs5,070 per Rs100,000.

The profit rate for six-month maturity category stands at 20.3 or Rs10,150 per Rs100,000. Similarly, the Qaumi Bachat Bank offers 20.34% profit or Rs20,340 per Rs100,000 on Short Term Savings Certificates with one year majority.

| Investment Maturity Limit | Profit Rate | Per Rs100,000 profit |

| 3-month | 20.28% | Rs5,070 |

| 6-month | 20.3% | Rs10,150 |

| 1-year | 20.34% | Rs20,340 |

The rate of tax to be deducted shall be as follows:

Filers: Persons appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 15% of the yield/profit irrespective of date of investment and amount/profit.

Non-Filers: Persons not appearing in Active Tax Payer List (ATL), Rate of Withholding Tax shall be 30% of the yield/profit irrespective of date of investment and amount/profit.

The investment made in STSCs will be exempted from collection of Zakat.