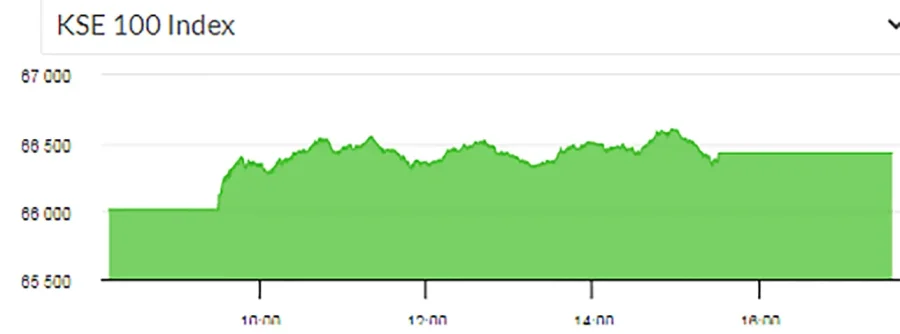

After a day of losses, bulls returned to the trading floor of the Pakistan Stock Exchange on Tuesday. According to the PSX website, the KSE-100 index gained 414.46 points to close at 66,426.78 points, up by 0.63 per cent from the previous close of 66,012.32.

The winning streak of major shares came to a halt on Monday as investors opted for profit-taking across the board. Analysts said power, oil marketing and banking sectors had received considerable selling pressure.

A report by Intermarket Securities painted a hopeful picture of the investment landscape, noting that “Pakistan is addressing the two key areas — politics and the economy — that have historically hurt the case for equities.”

The report highlighted that attention was turning to “resilient corporate profitability and cheap valuations, which was at a 50pc discount to the long-term mean.”

The analysts further predicted the benchmark index to reach 85,000 points, “driven by valuation rerating, as interest rates reduce and institutional buying returns.”