Shares recover on hopes of IMF programme revival

The rupee, which recently hit a record low, appreciated by Rs1.74 against the US dollar in the interbank market on Tuesday.

The local currency closed at Rs267.89, up 0.65 per cent from yesterday’s close of Rs269.63.

The rupee’s appreciation could be due to exporters offloading some of their proceeds.

In fact remittances and export proceeds had started pouring in days after the government removed an unofficial cap on the USD-PKR exchange rate.

The rupee had depreciated by Rs24.54 in the interbank market on Thursday after the government removed the price cap. It was the largest single-day depreciation in both absolute and percentage terms since the new exchange rate system was introduced in 1999.

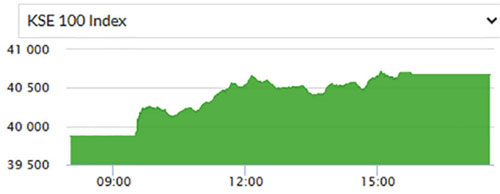

Meanwhile Shares at the Pakistan Stock Exchange (PSX) recovered on Tuesday as an International Monetary Fund (IMF) delegation arrived in Pakistan to discuss the revival of the stalled loan programme.

The benchmark KSE-100 index jumped 801.79 points, or 2.01 per cent, to close at 40,673.06 points. It reached an intraday high of 845.99 points, or 2.12pc, around 3:04pm.

The second phase of policy negotiations would continue till Feb 9 to finalise a memorandum of economic and financial policies (MEFP).