Staff Reporter

Karachi

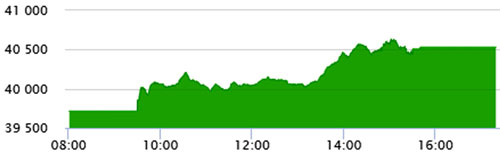

Stocks extended the rally on Wednesday as the index soared over 800 points to power past the 40,000-mark once again.

The bull-run was seen on back of strong investor sentiments, which fuelled buying across the board amid growing institutional interest ahead of major financial results due to be announced later in the week. Meanwhile, bullish global equity markets and surging global oil prices on the back of declining coronavirus cases around the world also lent further support to the index.

Trading kicked-off with a sharp spike, following which the index steadily increased throughout the session. Investors resumed buying spree after mid-day which propelled the index higher. At close, the benchmark KSE-100 index recorded an increase of 816.67 points, or 2.06%, to settle at 40,531.13.

JS Global analyst Danish Ladhani said equities closed Wednesday on a positive note with the benchmark KSE-100 Index gaining 816 points, closing at 40,531 levels.

“Market remained bullish during the trading session with value buying witnessed ahead of the result season,” he said.

A report from Aba Ali Habib Securities said that taking cues from Tuesday’s closing, benchmark KSE-100 index extended its bull run primarily on attractive valuation, some clarity on economic front and recovery in Asia-Pacific markets amid ease in coronavirus concerns.

“As per the news sources, the IMF has revised revenue collection target for FY20 to Rs4.9 trillion against Rs5.23 trillion, while FBR has stated that it has revenue collection capacity of up to Rs4.7 trillion,” it said.