Staff Reporter

Karachi

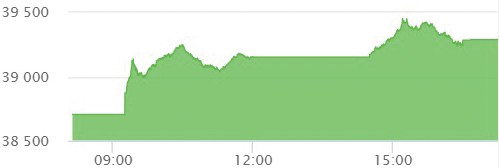

The benchmark KSE-100 index extended its rally from the previous day as bulls dominated trading on Friday, supporting the index cross the 39,000-point mark after nine months.

The extensive buying seems to be the result of political clarity following the Supreme Court’s verdict in the army chief tenure extension case.

The index shot up as soon as trading began and heavy buying continued in the first session, which closed with a gain of nearly 450 points. The second session further lifted the index but selling pressure towards the end wiped off some of the gains.

At close, the benchmark KSE 100-share Index recorded an increase of 581.38 points, or 1.5%, to settle at 39,287.65.

“A further improvement in the country’s foreign currency reserves encouraged investors to engage in extended buying,” Arif Habib Limited Head of Research Samiullah Tariq said while talking to The Express Tribune.

There was a correlation between the foreign currency reserves position and the KSE-100 index. “Both have recovered to the (early) March 2019 levels,” he said.

The analyst said the six-month extension in the tenure of Army Chief Qamar Bajwa ended political uncertainty in the country. This development also played a pivotal role in triggering extensive buying at the PSX. Arif Habib Head of Equity Sales Saad bin Ahmed said “the market is expected to cross the 40,000-point mark soon.”

JS Global analyst Maaz Mulla pointed out that Pakistan was expected to issue $1 billion worth of Panda bonds in Q1 2020 and State Bank’s foreign currency reserves rose by $240 million week-on-week, which supported the stock market’s advance. “Going forward, we expect the market to remain positive, however, investors are recommended to book profit on strength,” the analyst added.