Zubair Yaqoob

Karachi

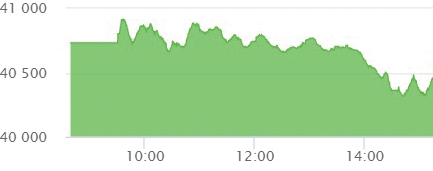

Market opened on a positive note on Monday at +72pts and 1.3M shares traded at opening. The benchmark index went up by 184pts in the morning and largely traded in a narrow range for good part of the session. Near close of session market saw profit booking, which brought the index down by 417pts and closed the session at -289pts. Banking, OMCs, Steel, Autos and Cement sector stocks saw major sell off. Cement sector led the volumes table with 44.3M shares, followed by Chemical (37.4M) and O&GMCs (31.4M). Among scrips, UNITY led the volumes with 26.8M shares, followed by MLCF (18.7M) and LOTCHEM (15.4M). The Index closed at 40,443pst as against 40,732pts showing a decline of 289pts (-0.7% DoD). Sectors contributing to the performance include Banks (-152pts), Cement (-65pts), O&GMCs (-58pts), Power (-45pts), Autos (-27pts), Fertilizer (+27pts), E&P (+24pts), Food (+22pts). Volumes declined further from 417.1mn shares to 320.1mn shares (-23% DoD). Average traded value also declined by 25% to reach US$ 73.5mn as against US$ 97.9mn. Stocks that contributed significantly to the volumes include UNITY, MLCF, LOTCHEM, PAEL and HASCOL, which formed 27% of total volumes. Stocks that contributed positively include ENGRO (+23pts), NESTLE (+18pts), OGDC (+13pts), MARI (+10pts) and EPCL (+8pts). Stocks that contributed negatively include UBL (-60pts), HBL (-37pts), LUCK (-35pts), PSO (-33pts), and HUBC (-30pts).