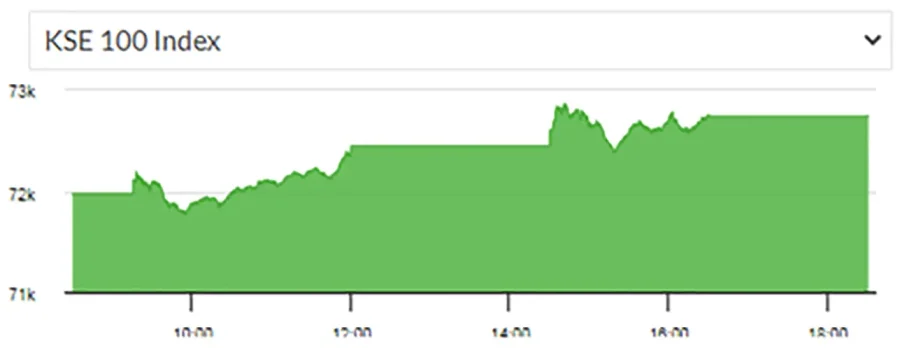

The Pakistan Stock Exchange’s benchmark KSE-100 index soared by over 700 points on Friday on anticipation of a cut in the key policy rate.

The benchmark KSE-100 index gained 771.34 points, or 1.07 per cent, to stand at 72,742.74 points at the day’s close from the previous close of 71,971.40.

Yousuf M Farooq, director of research at Chase Securities, said the market “is building in expectations of a rate cut”.

The State Bank of Pakistan’s monetary policy committee will meet on April 29 to take a decision regarding the key interest rate policy. Last month, the committee had chosen to maintain the status quo by upholding the key policy rate at 22 per cent for the sixth policy meeting in a row.

A Topline Securities survey from last week stated that 51pc of participants expect the policy rate will remain unchanged at 22pc, while the remaining 49pc anticipate a policy rate cut.

“We believe that the SBP will maintain cautious approach despite the above encouraging trends and adopt a ‘watch and see’ approach until the inflation trend maintain its fall,” the brokerage firm said. Farooq noted that the sensitive price index was down 1.1 per cent this week while most analysts were expecting inflation to clock in between 17-18pc. “Lower interest rates translate into higher stock prices,” he said.

Shahbaz Ashraf, chief investment officer at FRIM Ventures, observed that there were a “handful of reasons that summarise the current market performance”.