Zubair Yaqoob

Karachi

Market traded in a similar fashion as on Tuesday, whereby cement, fertilizer, banks saw profit booking / selling pressure, which was counterweighed by index heavy weights HUBC, ENGRO. On Wednesday MCB, HBL and Cement sector stocks (particularly LUCK) saved the day. ECC’s approval of Funds for construction sector gave Cement sector the reason to trade.

International crude oil prices increased over the day, which helped E&P stocks staged recovery. Cement sector topped the volumes with 59.8M shares, followed by O&GMCs (46.6M) and Technology (40.2M). Among scrips, HASCOL realized trading volumes of 21.2M, followed by UNITY (20M) and AGL (19.2M).

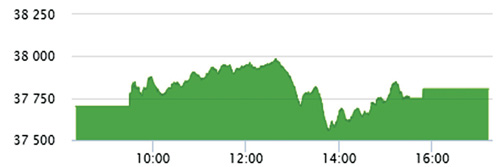

The Index closed at 37,805pts as against 37,700pts showing an increase of 104pts (+0.3% DoD). Sectors contributing to the performance include Cement (+79pts), Autos (+40pts), O&GMCs (+26pts), E&P (+20pts), Power (-37pts), Fertilizer (-25pts) and Insurance (-15pts).

Volumes declined from 457.2mn shares to 405.5mn shares (-11% DoD). Average trade value also declined by 9% to reach US$ 106.2mn as against US$ 116.5mn. Stocks that contributed significantly to the volumes include HASCOL, UNITY, AGL, FCCL and MLCF, which formed 24% of total volumes. Stocks that contributed positively to the index include LUCK (+71pts), MTL (+28pts), PSO (+18pts), MCB (+16pts) and HBL (+14pts). Stocks that contributed negatively include HUBC (-35pts), UBL (-34pts), ENGRO (-16pts), TRG (-11pts), and EFUG (-8pts).