Zubair Yaqoob

Karachi

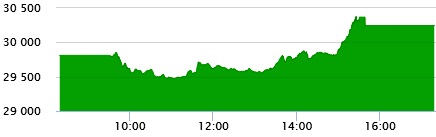

The release of CPI data proved to be a required stimulus that the investors were waiting for. The latest release of CPI indicates a lower than anticipated reading and gave confidence to the view that SBP will likely consider revising down the Policy rate. Buying activity was observed almost across the board with the exception of Banking sector scrips, which kept the blue chips in Banking Sector universe in red and the main reason behind -342pts earlier in the session. In totality, the index spiked by 568pts by close of session and ended at +557pts (unadjusted). Cement sector led the upsurge in the index, which was supported by O&GMCs and E&P sectors where OGDC and PPL also hit the upper circuit. Sectors that led the volumes table included Cement (29.2M), Banks (18M) and Technology (13.5M). Among scrips, MLCF (11.4M), FCCL (9.9M) and UNITY (9.4M) contributed to the performance. The Index closed at 30,244pts as against 29,810pts showing an increase of 435pts (+1.5% DoD). Sectors contributing to the performance include E&P (+148pts), Cement (+81pts), Fertilizer (+56pts), O&GMCs (+46pts), Power (+20pts), Banks (-33pts). Volumes doubled from 64mn shares to 128.7mn shares (+101% DoD).