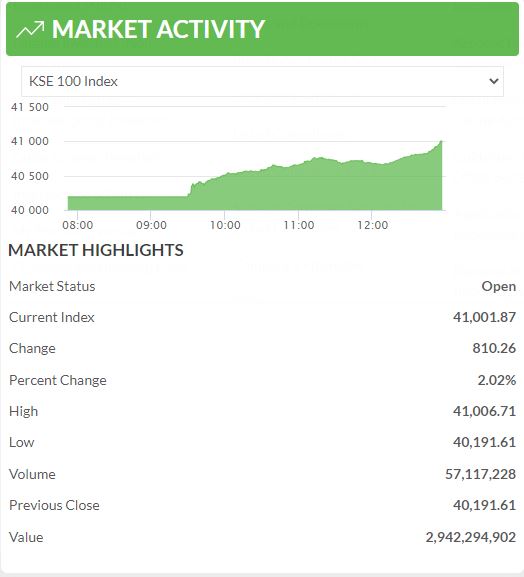

Karachi: The benchmark KSE-100 has gained over 800 points during intra-day trading on Wednesday, as clarity regarding the IMF deal attracted investors’ faith, analysts said.

At around 12:56 pm, the KSE-100 was being traded at 41,000, up by 2pc compared to the previous close of 41,191.

The rupee also strengthened after the International Monetary Fund (IMF) said that Pakistan completed the last precondition — increasing the levy on petroleum products — for the combined seventh and eighth reviews.

Reversal to Dollar flight

The Pakistani rupee also continued to recover in the intraday trade on Wednesday and gained Rs7.38 against the US dollar as the country’s imports witnessed a decline in July.

During the intraday trade, the dollar lost Rs7.38 and was being traded at Rs231 against the rupee, down from 238.38 from Tuesday’s close in the interbank.

Exports, Imports down in July

The first month of the current fiscal year saw a major decline in exports as it dropped by 24pc month-on-month basis to $2.2 billion during July of the fiscal year 2023 from June’s $2.9 billion, the Pakistan Bureau of Statistics reported on Tuesday.

Read: Exports down 24pc in July: PBS

According to the PBS, there was also a major downshift in the total imports as it also dropped by 38.3pc to $4.861 billion compared to a $7.9 billion recorded during June 2022.

This decrease in imports helped ease pressure on the local currency as Pakistan desperately needed a stop to forex reserves depletion.

This is an intraday update which means values may change with time.