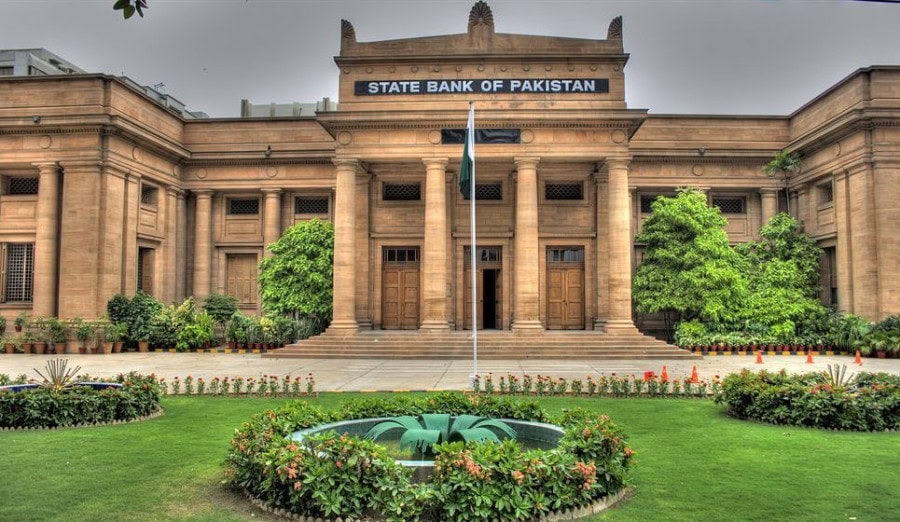

Islamabad: The immediate default risks of Pakistan faded as the State Bank of Pakistan Friday confirmed it repaid a $1 billion international bond amidst growing uncertainty about the country’s ability to meet external financing obligations.

According to Bloomberg, Pakistan transferred the payment on the sukuk bonds three days before its maturity to Citigroup Inc, which will distribute the funds to creditors.

The repayment came in line with the commitment made by SBP governor Jameel Ahmad, who had said a week earlier that Pakistan would repay the $1 billion international bond on December 2.

At the same time, it must be noted that the early repayment helped evade the risk of a near-term default, although concerns linger over Pakistan’s ability to pay its long-term debt.

Pakistan needs to repay about $25 billion in the fiscal year 2022-23, though most of it has been rolled over or paid, Ahmad said.

Saudi Arabia extends term for $3 billion deposit in SBP

The Kingdom of Saudi Arabia (KSA) has extended the term for a $3 billion deposit in the State Bank of Pakistan (SBP) through the Saudi Fund for Development (SFD) “in support of the Pakistani economy”, the SBP revealed on Friday.

The development has come in support of the reeling economy of Pakistan.

“The Saudi Fund for Development (SFD) extended the term for the deposit provided by the Kingdom of Saudi Arabia in the amount of 3 billion dollars to the State Bank of Pakistan,” a statement from the central bank read.

The statement further read that the extension of the term of the deposit was a continuation of the support provided by the government of the Kingdom of Saudi Arabia to the Islamic Republic of Pakistan.

It said that the development followed the directives of the Custodian of the Two Holy Mosques, King Salman bin Abdulaziz Al Saud.

“The deposit [is] aimed to shore up the foreign currency reserves in the Bank and help Pakistan in facing the economic repercussions of the COVID-19 pandemic; it, furthermore, contributed to meet external sector challenges and achieve sustainable economic growth for the country.”

It is important to note that the $3 billion deposit agreement was signed through the Saudi Fund for Development (SFD) with the State Bank of Pakistan in November of the last year 2021, after the issuance of the royal directives that reflect the continuation of the close relationship between the two countries.