ISLAMABAD – The Federal Board of Revenue (FBR) has announced the Tajir Dost Scheme 2024 to bring small traders and shopkeepers into tax net as the government aims at increasing revenue generation and documenting the businesses in the country.

The top tax body has also issued SRO in this regard, announcing that registration of all traders and shopkeepers operating through a fixed place of business including a shop, store, warehouse, office or similar physical place (hereinafter referred to business premises) located within the territorial civil limits including cantonments will be registered under the scheme.

The registration of the retailers will commence from April 1, 2024. Following are the three ways to get registered with the Tajir Dost Scheme:

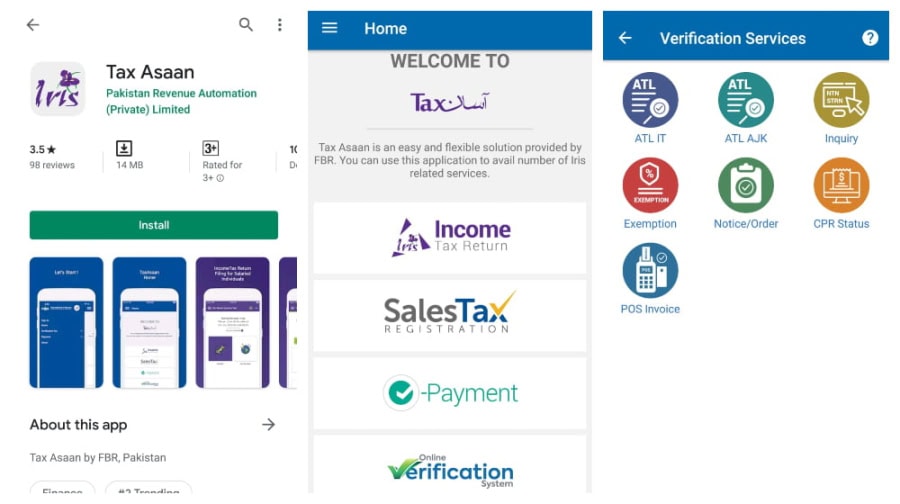

Tajir Dost App FBR (Tax Asaan App)

Every trader and shopkeeper can apply for registration in the National Business Registry through Tax Asaan app, which is available for both Android and iOS systems.

FBR’s Portal

They can also apply for the registration through the online portal of the Federal Board of Revenue.

FBR’s Tax Facilitation Centers

Traders and shopkeepers can also visit the FBR’s Tax Faciliation Centers for registration. They are required to get registered with the scheme by April 30.

If a person, who is required to be registered, does not apply for the registration, the Commissioner Inland Revenue shall register the trader or the shopkeeper as the case may be, the notification said.

The second part of the SRO regarding payment of minimum advance tax will come into force from July 1, 2024.

“Every person shall be liable to pay monthly advance tax in accordance with this paragraph.

(2) The advance tax paid under sub paragraph (1) shall be the minimum tax in respect of income from the business covered under this scheme.

(3) The amount of monthly advance tax for a tax year shall be computed in the manner as may be prescribed.

(4) Where the advance tax computed under sub paragraph (3) is zero, the advance tax payable under the sub paragraph (1) shall be Rs. 1,200 per annum. Provided that where the income of the person is exempt from income tax under any provision of the Ordinance, sub-paragraph (1) shall not apply.

Provided further that the advance tax payable shall be reduced by twenty five percent of the whole or the balance: —(a) if the person pays in lump sum the whole or the balance as the case may be, of remaining advance tax for the relevant Tax Year,” read the SRO.