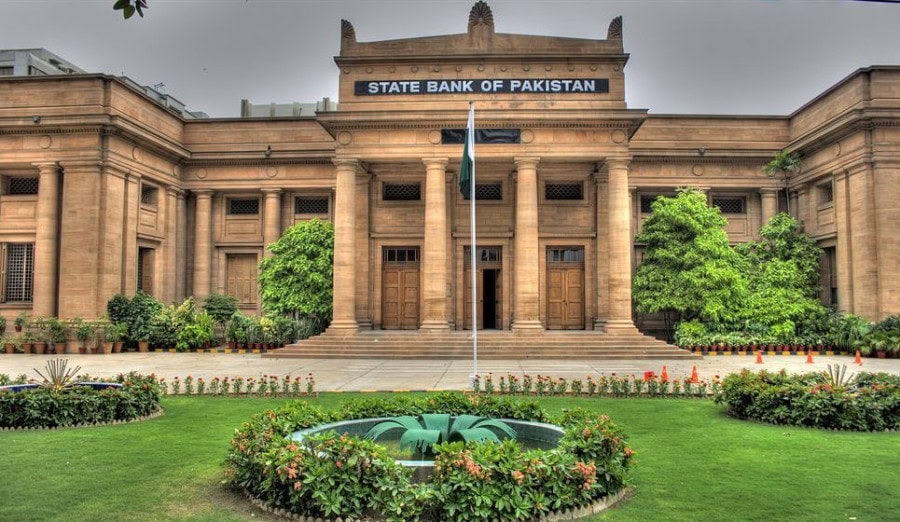

Karachi: The State Bank of Pakistan on Thursday released its third quarterly report of Payment Systems for the Fiscal year 2021-22, covering the period January to March 2022. The report established that the third quarter witnessed an increase of 2.6 per cent in volume and 6.5 per cent in value on a QoQ basis, while the overall growth was 32.7 per cent in volume and 57.5 per cent in value on a YoY basis.

Read: Digital payments continue strong growth trend in 2nd Quarter of FY22

“The report presents an overall viewpoint of growing digital adoption in the country as SBP continues to promote robust and efficient payments ecosystem in the country.”

1/2 #SBP issues Q3FY22 report on Payment Systems that shows growing digital adoption in Pakistan. Overall e-banking transactions volume grew by 2.6% whereas value by 6.5% while the overall growth was 32.7% in volume and 57.5% in value on YoY basis. pic.twitter.com/ITjzDZyCit

— SBP (@StateBank_Pak) June 16, 2022

Giving further details about the adoption of the e-banking system across the country, the report added that a significant portion of this growth was driven by “continuing widening in internet banking and mobile banking transactions.” The number of registered internet banking users reached 7.6 million showing a growth of 10.6 per cent, resulting in a double-digit growth of 13.5 per cent and 19.9 per cent in volume and value of transactions, respectively, on a QoQ basis. Through this channel, a total of 38.3 million transactions worth Rs 2,906.9 billion were processed.”

Mobile banking transactions volume was 101.5 million with a value of Rs 3,085.8 billion which amounted to a growth of 8.1 per cent and 5.4 per cent, respectively, on a QoQ basis.

“Paper-based transactions declined by -2.9% in volume, though its value remained almost at the same level posting only 0.6% growth over the previous quarter. In [the] case of RTGS (PRISM), the real-time gross settlement system of Pakistan, a total of 1.08 million transactions amounting to PKR 155.7 trillion were processed.”