Amraiz Khan

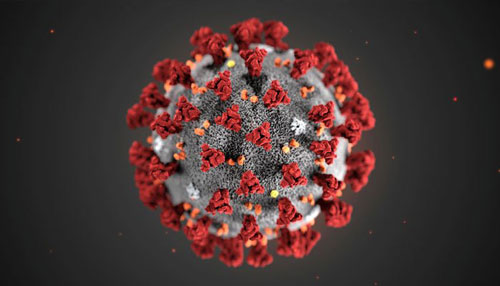

Punjab Finance Minister Hashim Jawan Bakht said that the province witnessed an increase of 9 percent in indigenous revenue generation in the first six months of the ongoing fiscal year despite the covid-19 relief was given to the industries and taxpayers. The minister observed that despite the reduction in tax rates, Punjab sales tax on services increased by 45 percent, motor vehicle registration improved by 46 percent, the tax on immovable property, farmhouses and luxury houses has been collected at 63 percent of the estimated revenue.

Furthermore, the Punjab Revenue Authority collected 60 percent of the estimated revenue in the budget 2020-21, Excise and Taxation collected 53 percent and the Board of Revenue collected 48 percent. The minister presiding over the 4th meeting of the Cabinet Committee on Resource Mobilization here on Wednesday appreciated the performance of the Punjab Revenue Authority (PRA) on 45 percent increase of GST on services during the first half of the fiscal year.

He also backed up the performance of the Excise and Taxation department on achieving an increase of Rs 2.2 billion in property tax demand. Further, the minister instructed the excise and taxation department to ensure the issuance of number plates and increase in vehicle registration besides reviewing the rate of registration fee.

The growth rate of collections in PRA and Excise and Taxation was positive while in the Board of Revenue it was negative. The decline in economic activity due to Corona affected recovery rates. However, the minister asked the Board of Revenue (BOR) to improve its performance of revenue collection and the revenue targets set on the request of the department should not be missed by the end of the fiscal year.

Further, the minister directed the BOR to improve the collection of Agriculture Income Tax. The minister instructed the excise and taxation department to speed up the survey for property tax so that the defaulters can be brought into the tax net in the next financial year. Similarly, Punjab Revenue Authority should assess the impact on industries for resolving issues related to infrastructure development.

Earlier, the Finance Secretary apprised the meeting of the steps taken in the first three sessions of the Resource Mobilization Committee and said that the business model set up to make WASA self-sufficient has been sent to the Cabinet for approval. The finance department will be able to save Rs 6.2 billion.

He further said that in-principle approval of self-sufficiency model has also been taken for e-service centers in Punjab. A working group has been formed for tax reform on immovable property. It will introduce a new model to replace the old valuation model. The concept of benefit taxation is being introduced in the local bodies to increase tax collections. The property tax collection mechanism is being improved.

Other participants of the meeting included Provincial Minister for Revenue Malik Anwar, Secretary Treasury, Secretary Excise and Taxation, Member BOR, Chief Executive Officer Punjab Urban Unit, Chairman Punjab Revenue Authority and concerned officers of Tax Departments.