ATMs are common in Pakistan, and are widely used providing convenient access to cash and banking services. Banks in Pakistan have extensive networks, and there is a growing trend towards digital and mobile banking which complements ATM usage.

ATMs often help in cutting need to visit bank branches for basic transactions, making financial services more accessible to a larger population. These charges are mainly due to operational costs, interbank transaction fees, and to encourage the use of bank’s own ATMs.

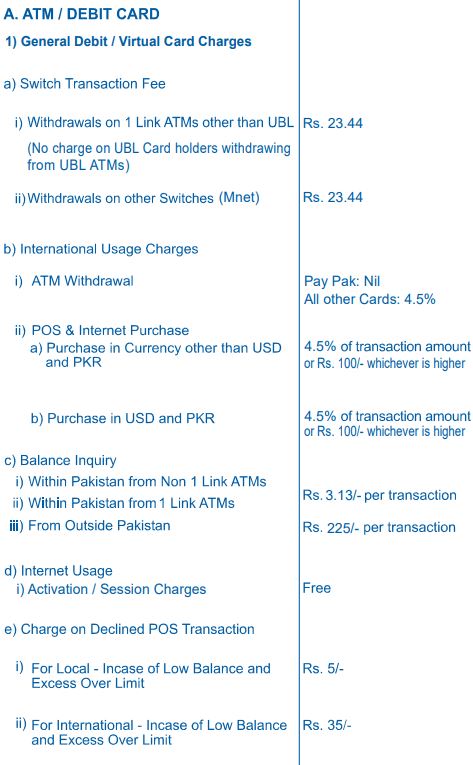

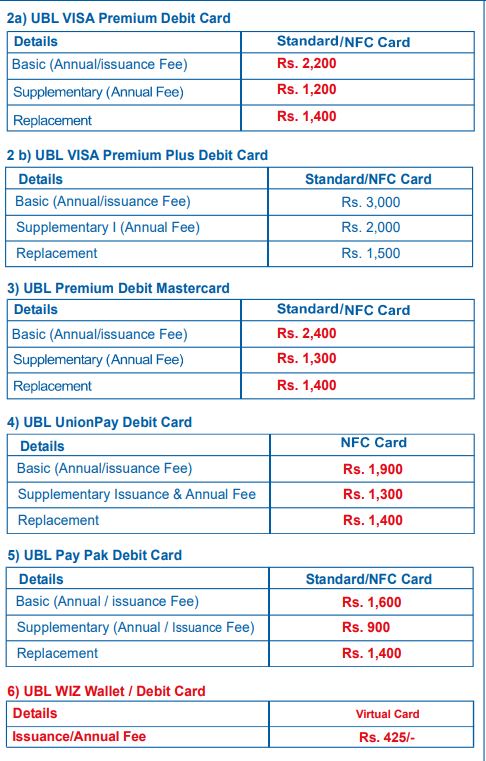

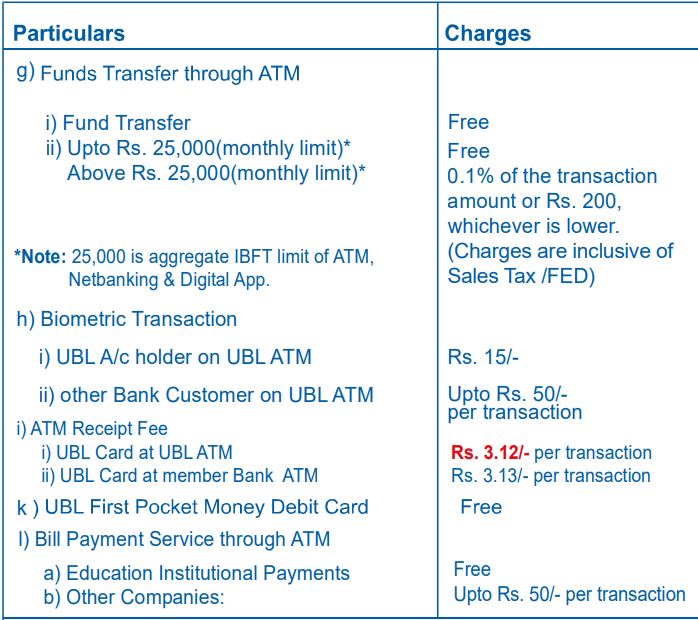

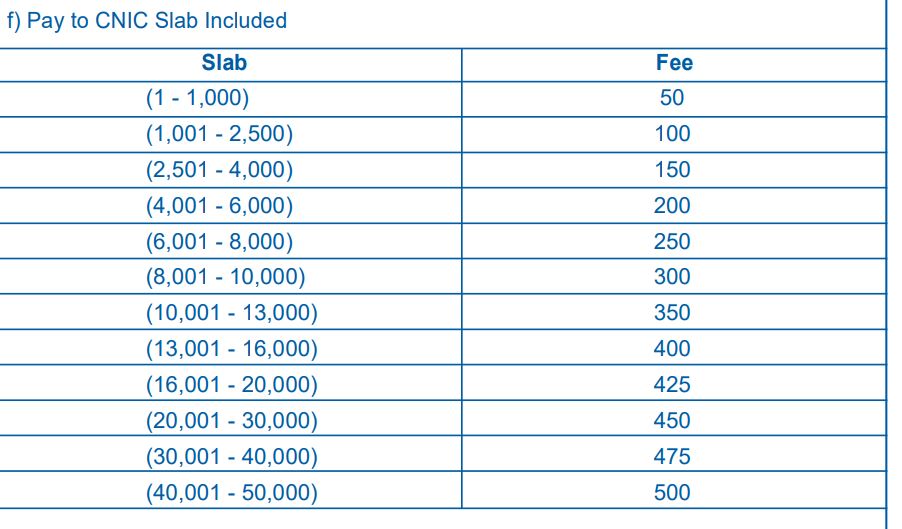

The charges often depend on the bank and type of transaction as they help banks cover their expenses, they also place a financial burden on consumers. These charges often vary and the following are the charges of United Bank Limited UBL for 2024.

UBL ATM Card Charges 2024