Hong Kong,

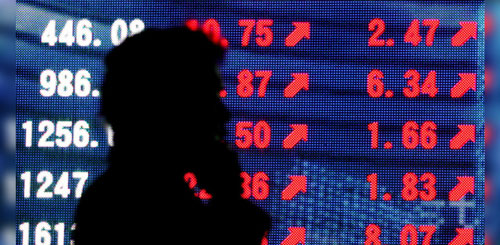

Asian markets sank Monday following big losses on Wall Street as inflation worries and the spreading Delta virus variant fuel worries about the global recovery, while oil prices also sank after top producers reached a deal to hike output.

Hong Kong was the worst hit after the United States warned businesses about the “growing risks” of operating in the city as China tightens its grip, raising concerns about its future as a financial hub.

With vaccines being rolled out around the world and some governments easing lockdowns, equities enjoyed a healthy first half of the year, with many hitting records or multi-year highs as traders bet on a strong rebound from last year’s pandemic-induced collapse.

But the frightening spread of the highly transmissible Delta variant has thrown a spanner in the works as leaders in several countries — particu-larly those with slow inoculation programmes — reimpose lockdowns and other containment meas-ures.

Even in parts of the world where most people have been jabbed and reopenings continue, such as England, there is a growing concern about a surge in new cases.

That has raised worries that the expected recovery will not be as strong as first hoped.

Meanwhile, a surge in inflation has re-kindled speculation that the Federal Reserve and other central banks could be forced to wind down their ultra-loose monetary policies and raise interest rates sooner than expected.

Treasury Secretary Janet Yellen last Thursday warned prices rises will continue to be strong for the next few months but that they would eventually slow down.

“Markets are… dealing with a burst of inflation pressure that hasn’t been observed for quite some time,” said Michael Hood, at JP Morgan Asset Management.

He said there was “uncertainty about whether it will be temporary or lasting, and a Fed-eral Reserve that is viewing all this through the lens of an untested and somewhat vague new framework, which they’ve not been able to communicate very clearly about”.— APP