ISLAMABAD – The coalition government is set to roll out Rs170 billion mini budget dubbed as Supplementary Finance Bill 2023 in both houses of the parliament, for which separate sessions of the National Assembly and Senate have been summoned.

After getting a cold shoulder from IMF, the government, apparently in a frenzy, increased the general sales tax from 17pc to 18pc and jacked up the federal excise duty (FED) on cigarettes with immediate effect.

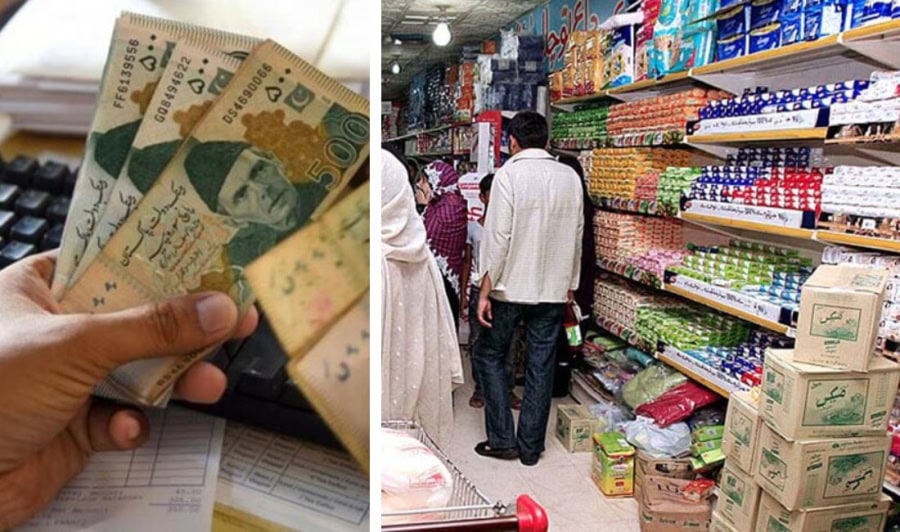

The hiked General Sales Tax will be imposed on several essential consumable and industrial goods. Here is a quick review of items that will see a sharp price hike after the approval of the supplementary finance bill.

Food & Dairy

Foremost Edible oil, ghee & butter, biscuits/cookies, spices and sauces, jam/jelly, chocolates, noodles, toys, Cheese, and coffees will become more expensive as the country of over 220 million is battling one of the worst economic crisis.

Cosmetic products

Besides the above-mentioned edibles, cosmetic products mainly expensive soaps, shampoos, creams, moisturisers, and even toothpaste will see a sharp increase in price.

Electronics

Sales tax on Televisions including all types of LED, LCD, and smartphones, iPods, computers, laptops and gadgets, juicers, blenders, shakers, and other kitchen appliances will also increase.

With the increase of a mere 1 percent in the Goods and Services Tax, the masses will bear the brunt of a whopping Rs50 billion, and that’s at a time when households in South Asian nation are unable to meet their nutritional needs.

The bitter pill is however the only option as IMF and other lenders tabled strict requisites for the stalled bailout package.