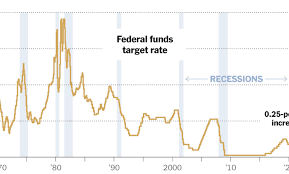

The Federal Reserve declared on Wednesday that it has achieved a significant win in the battle against high inflation, but the “won” would still necessitate more increases in its benchmark overnight interest rate, which must stay high at least until 2023.

After a year of larger rate increases, the US central bank announced its latest policy decision, scaling back to a quarter-percentage-point increase. In its statement, it ignored the lengthy list of factors, from war to pandemic, that were raising prices to merely state that “inflation has eased.”

The Fed is expected to pause soon and, in fact, cut rates later this year, but policymakers also predicted that “ongoing increases” in borrowing costs would be necessary. This commitment was vague and did not specify when the rate hikes might end.

However, investors drew a dovish lead from comments made by Fed Chair Jerome Powell, who frequently mentioned the “disinflationary” process that appeared.

Although the economy hasn’t yet fully absorbed the effects of that tightening of monetary policy, the “modest” economic growth and “strong” job increases that the Fed highlighted in its most recent statement have.

The central bank is prepared for “ongoing hikes” in its policy interest rate in part because of this resiliency.

Powell said it’s still unclear how much higher rates will need to go given that inflation is still high and economic demand is better than many had anticipated. As of December, Fed policymakers predicted that the peak policy rate would be 5.00% and 5.25%, which is in line with Powell’s comment that there would likely be “a couple” more rate hikes shortly.