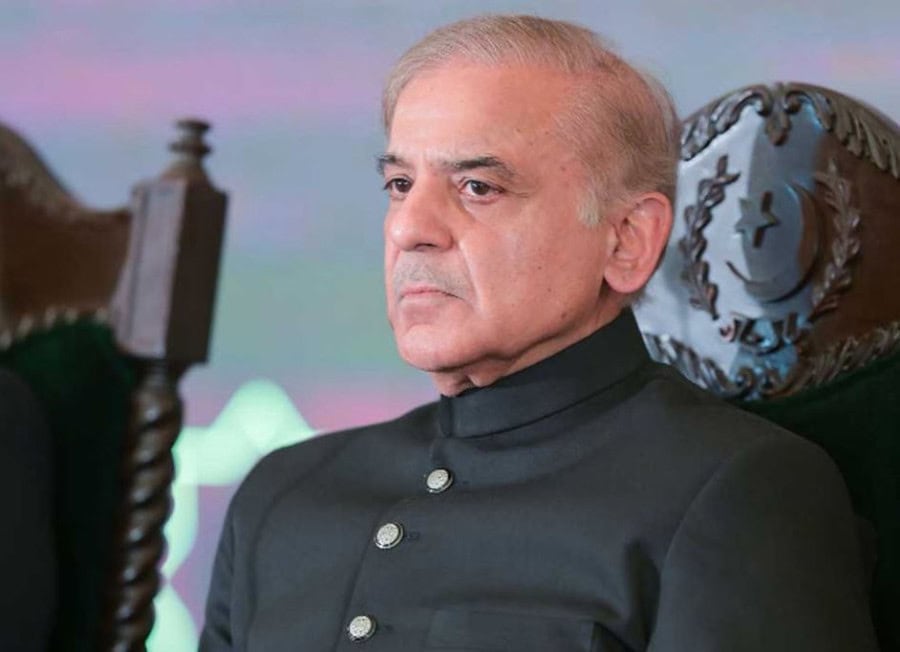

Prime Minister Shehbaz Sharif has directed the authorities concerned to take action against illegal cigarette factories after International Monetary Fund (IMF) raised concerns over ‘tax evasion’ of Rs80 billion, sources said Monday.

According to details, the prime minister issued the directives during a meeting after the Fund expressed reservation over ‘tax evasion’ of Rs80 billion through trade of illegal cigarettes.

PM Shehbaz has directed Federal Board of Revenue (FBR) to complete the track and trace system on all the cigarette manufacturing companies.

Sources said that FBR Inland Revenue Intelligence teams would launch a crackdown on illegal cigarette factories across the country and a report on the matter would also be shared with the IMF.

Sources further claimed that almost 24 cigarette manufacturing companies were still not included in the track and trace system.

During the meeting, the Ministry of Finance and FBR briefed the prime minister on the trade of illegal cigarettes. The FBR has been directed to submit its monthly report on crackdowns on illegal cigarettes to the Prime Minister’s Office.

Earlier in February, the federal government enhanced taxes on cigarettes with immediate effect to collect Rs115 billion out of the planned Rs170 billion mini-budget.

According to the notification issued by FBR, the standard rate of General Sales Tax (GST) was jacked up from 17 to 18 percent with effect from February 15, 2023. The Federal Excise Duty (FED) on cigarettes was also gone up.

The government increased FED on expensive brands from Rs6.5 per cigarette to Rs16.5 – an increase of 153%. For less expensive brands, per stick increase is from Rs2.55 to Rs5.05 – an increase of 98%.