The State Bank of Pakistan (SBP) has directed commercial banks to enhance their Islamic banking footprint in order to promote the Islamic banking system in the country.

It has been decided to allow banks and MFBs having Islamic banking operations to revise their Annual Branch Expansion Plan (ABEP) for 2023 to the extent of including additional Islamic banking branches, offices, and conversion proposals, according to the circular issued to banks.

The notification was issued in light of the direction of the government, which announced to eliminate the riba-based economy and banking system within the country in the next five years. This leads to the promotion of an alternate banking system, namely the Islamic banking system, which has been growing by leaps and bounds in the country, as the majority of the general population prefers this model over interest-based banks.

These commercial and microfinance banks (MFBs) may also consider replacing conventional banking branches and offices, as proposed in the ABEP 2023, with Islamic banking branches and offices.

Further, those banks and MFBs that have not opted for any expansion during the year 2023 are also encouraged to submit their ABEP-2023 by including theirs for the opening of new Islamic Banking branches and offices and conversion proposals.

Accordingly, concerned banks and MFBs may revise their ABEP-2023 by including the maximum possible number of new Islamic banking branches, offices, and conversion proposals and resubmit the same before December 16.

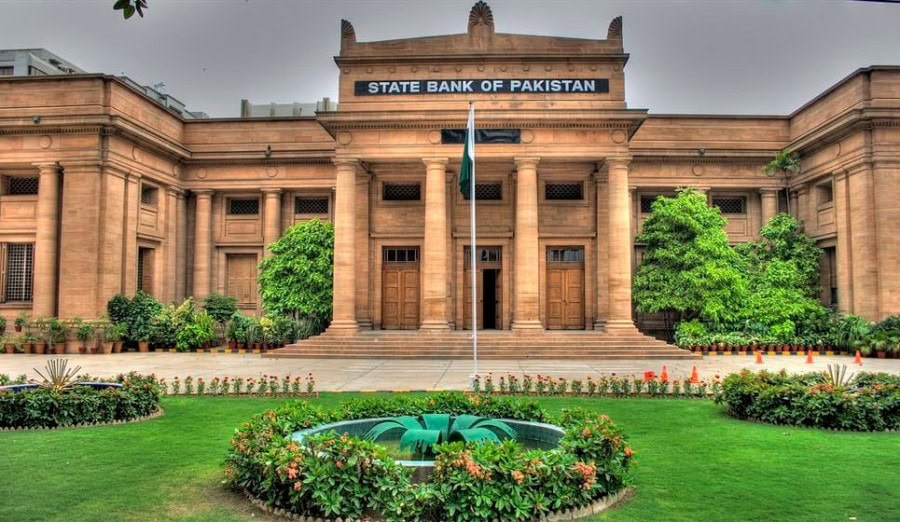

In a recent conference held by the National Institute of Banking and Finance (NIBAF) in collaboration with the Institute of Cost and Management Accountants of Pakistan (ICMA Pakistan), Jameel Ahmed, Governor SBP, said the transformation of the banking system from conventional to Sharia-compliant mode in light of the decision of the Federal Shariat Court and the growth in digital technologies offer a huge opportunity for the growth of the banking industry.

He reaffirmed the assiduous support being offered by SBP in the advancement of digital transformation and unwavering support for Islamic banking transformation in the financial industry.

Federal Minister for Finance and Revenue, Ishaq Dar, said the transition of the banking and economic system from interest-based to Sharia-based is possible in the next five years, provided all stakeholders work consistently in true letter and spirit.

He announced that a special wing will be established in SBP to promote interest-free banking. This wing will make recommendations, propose reforms, and formulate a framework to swiftly transition from a conventional interest-based economy to an Islamic riba-free economy.

There are overall 32 banks operating in Pakistan, including five full-fledged Islamic banks and 17 conventional banks with Islamic banking windows and divisions. Out of 11 microfinance banks, 3 banks kicked off Islamic banking services. There are more than 4,000 branches operating in the country, while the share of the Islamic banking system stands at 20% in overall assets and deposits of the banking system.—Agencies