Prudential regulations: Power of Central Bank

A few days ago, the State Bank of Pakistan is sued some regulations for the commercial banks in the country.

These include regulation for consumer financing and car financing. Through these regulations, the maximum duration for car financing was reduced from 7 years to 5 years, and the maximum amount for car financing was fixed at 3 million.

These kinds of regulations are called prudential regulations and this is the power of the State Bank which the bank forgot to use for a long period.

The objectives that the State Bank wants to achieve by increasing the policy rate can be better achieved by such prudential regulations.

Objective of increasing policy rate is to manage the aggregate demand. If the policy rate is low, the people will find it easy to purchase the car, and this ease can increase the demand for cars, leading to higher prices in the car market. At such a point, the State Bank of Pakistan would increase the policy rate to reduce the demand.

But sometimes the increase in policy rate could be counterproductive and it carries several negative consequences. Increasing the policy rate will make the business loans expensive which can reduce the aggregate supply.

Due to this reduction in aggregate supply, the prices may go up instead of going down. Similarly, the markup on the public debt is associated with the policy rate and high policy rate leads to higher markup payments.

The government needs to increase taxes to finance these additional payments which will put upward pressure on prices.

Similarly, by increasing policy rate, it will become more difficult for the startups to get loans, restricting the opportunities for new employment. Collectively, these consequences may lead to an economic recession.

Among the consumer loans, not every kind of loan deserves the same package of concessions. If a loan is to be issued for house building, it deserves a concessional treatment and a loan for the purpose of purchasing luxury cars does not deserve any such concession.

A differential package of concessions for different kinds of loans is possible only through the prudential regulations.

For example, the State Bank may direct the commercial banks not to release loans for cars and luxuries at less than KIBOR+10 and not to release the loan for house financing at more than KIBOR+3.

With the prudential regulations, the State Bank can manage many other desirable objectives. For example, the State Bank may direct the commercial banks to put at least 40% of their advances in the business financing and to put at least 40% of these business loans for the startups.

Similarly the State Bank can bind the commercial banks to put at least 10% of their advances in house financing.

Since the businesses financed by commercial banks are most likely to be formal, it will be manageable to make sure that the regulations of State Bank are followed by the banks and it is also possible to make sure that the demand contraction occurs only in the goods targeted by the bank.

On the contrary usually the State Bank uses the policy rate to reduce the aggregate demand. For example, on September 20, the State Bank increased the policy rate by 0.25% with the objective to reduce the current account deficit by reducing demand for imported goods.

This 0.25% increase is actually meaningless for those who want to purchase luxury cars; however, the negative consequences of the policy rate would continue to hit the economy.

As stated earlier, the mark-up payments on public debt are associated with policy rate and a hike in policy rate will increase the mark-up payments which are already constituting the largest part of the federal budget.

At present 33% of the federal budget is consumed in the markup payments and the recent hike in policy rate will increase this share further.

The policy rate in Pakistan is already very high. The current policy rate is 29 multiples of the policy rate in the United States and 72 multiples of the policy rate in the United Kingdom.

Pakistan needs to pay 29 billion on a debt for which the United States pays only one billion. If the policy rate of the US was applicable to Pakistan, Pakistan would need to pay only 100 billion as markup on domestic debt, whereas at present the country pays more than 2700 billion for the purpose. Such a high policy rate makes business loans very expensive.

With a 7.25% policy rate, it is not feasible to issue a business loan at less than 10%, but in the countries where policy rate is less than 1%, it is quite possible to issue a business loan at 2 to 3%.

With such a huge differential, Pakistani businessmen cannot compete with the businessmen from other countries.

Due to these reasons, I have been advocating for a long time to stop using policy rate to control inflation.

During 2021, about 25 countries of the world increased their policy rate with the objective of controlling inflation but so far, there is no statistical evidence to prove that the action has been successful in any of these 25 countries. In order to reduce inflation and to reduce the aggregate demand, prudential regulation could be used.

Using these regulations, it would be possible to target a particular sector to reduce the demand. The increase in policy rate would shift the burden of increase the markup payment on public, making the life more difficult for the layman.

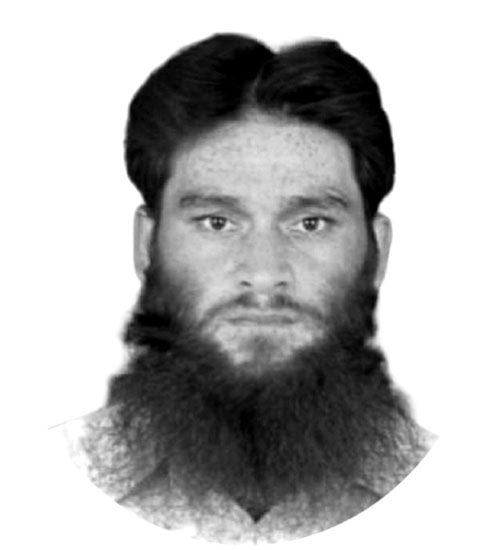

—The writer is Director, Kashmir Institute of Economics, Azad Jammu and Kashmir University.