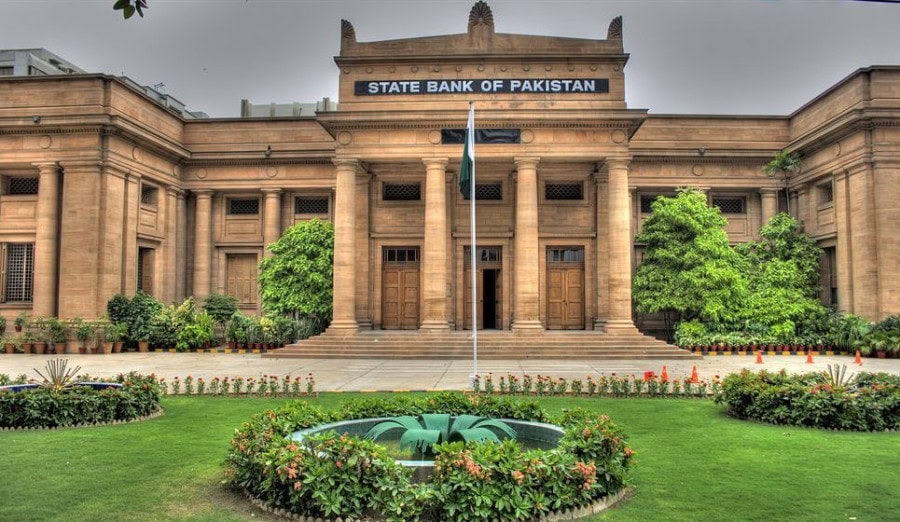

State Bank of Pakistan, Thursday, stated that banking system in Pakistan is safe and sound under a robust regulatory and supervisory framework of SBP with a layer of protection through insurance cover and all the deposits were perfectly safe.

The banking system in Pakistan is adequately capitalized, highly liquid and profitable and its ability to withstand a set of severe shocks has further improved while 94% of the depositors were fully protected under the Deposit Protection Act 2016, the central bank clarified through a statement issued here.

The SBP spokesperson said that certain sections of the media, on the basis of a statement given by Deputy Governor SBP, Dr. Inayat Hussain during the meeting of Senate Standing Committee on Finance and Revenue, were implying as if bank deposits above Rs500,000 in the banking system in Pakistan were unsafe.

The SBP categorically stated that the deposits were safe owing to a sound banking system in Pakistan that was working under a robust regulatory and supervisory framework of SBP while the sector was adequately capitalized, highly liquid and profitable with a low level of net non-performing loans, i.e. bad loans.

The banking sector posted a strong profitability of Rs284 billion in first half of CY23, which is almost 125 percent higher than the first half of CY22 and the higher earnings, in turn, also strengthened the capital of banks and the Capital Adequacy Ratio (CAR) of the banking sector increased to 17.8 percent by end June 2023 compared to 16.1 percent as of end June 2022.—APP