Zubair Yaqoob

Karachi

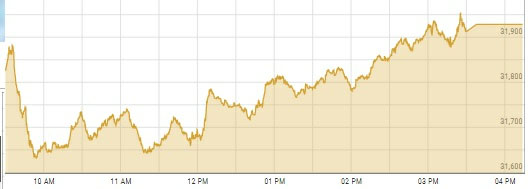

KSE100 index leapt +345pts at the start, which was mainly contributed by E&P stocks. Over the weekend, the attack on Saudi Oil facility caused international crude oil prices to surge by 10%. E&P stocks reacted to this change and after an initial spike, OGDC, PPL traded near Upper circuits for good part of the session, and ultimately hit upper circuits. This was followed by activity in Refinery and OMC sectors, which also saw stock prices of underlying stocks hit upper circuit.

By the end of session, DGKC announced its financial results depicting loss in last quarter, yet announcing 10% dividend. Traded volume increase significantly in DGKC, post results, but the price remained in red. Cement sector led the volumes table with 14.9M shares, followed by E&P (10.7M) and O&GMCs (10.5M). Among scrips, DGKC led the volumes with 6.7M shares, followed by OGDC (6.7M) and HASCOL (5.7M).

The Index closed at 31,929pts as against 31,481pts showing an increase of 447pts (+1.4% DoD). Sectors contributing to the performance include E&P (+225pts), Banks (+159pts), O&GMC (+37pts), Fertilizer (+28pts), Pharma (+16pts), Cement (-23pts) and Insurance (-10pts). Volumes showed nominal growth of 1.4% DoD to reach 10.6mn shares as against 103mn shares. Average traded value also increased by 6% to reach US$ 31.9mn as against US$ 29.9mn. Stocks that contributed significantly to the volumes include DGKC, OGDC, HASCOL, UNITY and KEL, which formed 28% of total volumes. Stocks that contributed positively include OGDC (+83pts), PPL (+75pts), UBL (+55pts), POL (+50pts) and HBL (+43pts). Stocks that contributed negatively include HUBC (-25pts), LUCK (-23pts), MUREB (-8pts), AICL (-5pts), and EFUG (-5pts).